A Bittersweet Weekend

This weekend brings mixed emotions. On one hand, we’re glad to hear Warren Buffett plans to retire at the end of the year—he’s 94 and deserves time with his family and friends. On the other, the investment world is losing one of its last truly honest, responsible voices. In an era filled with noise and stock-pumping influencers claiming to help the "little guy," Buffett’s absence will be deeply felt. We wish him health and happiness in retirement.

Technicals Still Strong — For Now

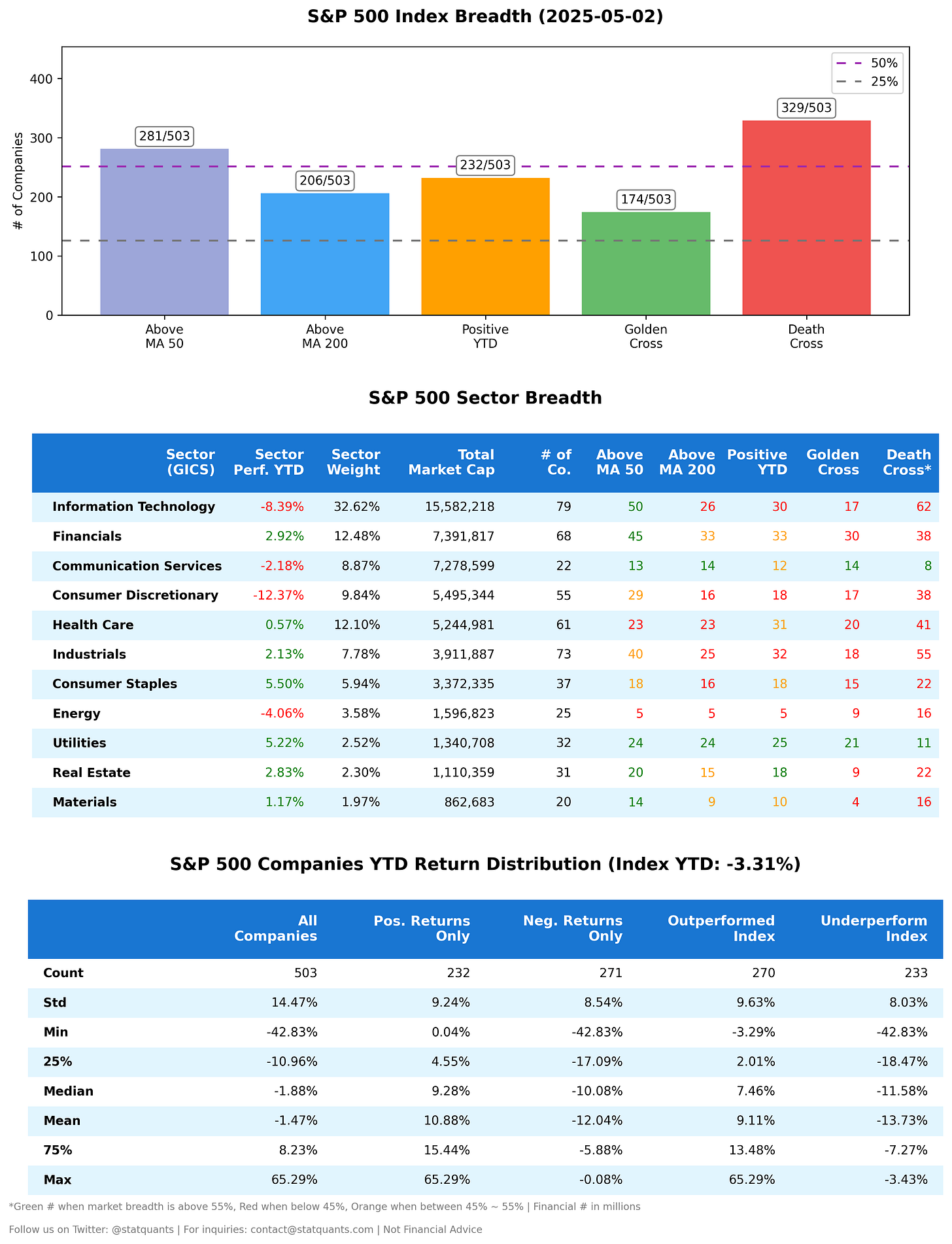

From a purely technical standpoint, the market remains bullish. The S&P 500 is on the verge of reclaiming its 200-day moving average. If recent patterns hold, we may see a test—or even a breakout—above that level soon. Whether that move sustains or not, only time will tell.

Still, we caution against leaning too heavily on technicals in this environment. One tweet or headline can erase key support or resistance levels in an instant. That said, most S&P 500 investors—even those who bought in at all-time highs—are in the green. This gives even short-term traders a bit more room to tolerate a pullback.

Options positioning suggests that anxiety has eased. The 6,000 SPX strike is back in the conversation. Barring any major negative surprises, the path of least resistance could be higher for now. But given all we've discussed in recent weeks, we’re not chasing.

Fundamentals: Still No Clear Trend of Improvement

Despite strong price action, we don’t see a clear or sustainable trend of improvement in the underlying fundamentals.

Markets are pricing in optimism—hopes of trade deals, tax cuts, and deregulation—but much of this is speculative or symbolic. For example, while China has signaled interest in evaluating the talks, it’s also demanding all tariffs be removed upfront—a non-starter for the U.S. Both sides continue to find workarounds like tariff rebates, but the core issues remain unresolved. Any temporary truce may just be a way for both sides to save face without real change.

Economic data isn’t offering clarity either. Much of it is distorted or of declining quality. Take unemployment numbers: programs like Washington State’s SharedWork allow companies to reduce hours without triggering layoffs, masking the true state of the labor market. Headlines may paint a "Goldilocks" economy, but reality on the ground may be more fragile.

“The SharedWork program can help employers prevent layoffs with the flexibility to retain employees at reduced hours during economic downturns. SharedWork allows you to reduce your employees' usual hours from 10% to 50%. Your workers collect unemployment benefits to replace part of their lost wages. A SharedWork plan can last up to 1 year. You can reapply when your plan ends.”

Earnings haven't collapsed, but that’s not the same as saying fundamentals are improving. Q1 came in roughly as expected. Q2 could see a mixed bag as companies deal with tariffs—some benefiting from demand being pulled forward, others absorbing the blow.

Wall Street hasn’t significantly revised down earnings estimates yet, but that could change. When they do adjust, it will likely be gradual, tied to trade developments. If talks stall or drag on beyond the current 90-day window, we may see a correction as optimism fades. Already, the S&P is more expensive today than it was at the start of the year—trading near 22x forward earnings despite the pullback from high. That could turn into a triple whammy if the trade situation deteriorates further: slowing growth, recession fears, and stretched valuations.

If you’ve been buying recent dips, it might be wise to reduce risk with covered calls. For example, if you were fortunate enough to buy $SPY around 520, you could sell a September 30, 2025, at-the-money covered call for about $35, roughly 6% over four months. If SPY pulls back again, that premium effectively lowers your cost basis to 485, giving you more breathing room to hold through volatility. And if things worsen after September, you can sell another call to lower your basis by another 6–10%, depending on the duration when volatility spikes. This approach will put you in a much stronger position to decide whether to hold or rotate, without getting caught up in a momentum-driven, headline-sensitive market.

Stay opportunistic—but not too greedy.

Corporate Insiders Remain Net Sellers

Worth a Read

Lastly, we’d like to share a thought-provoking piece we came across this week, with a foreword by Marko Kolanovic. While often unfairly labeled a perma-bear, Marko lays out a compelling case that’s hard to ignore in today’s market. We found ourselves nodding along with much of what he wrote—until we hit the paywall.

Earnings This Week

For the week of May 05, 2025, notable earnings releases for companies with a market cap above $2 billion include:

2025-05-05: AM CMI 0.00%↑ ARES 0.00%↑ BNTX 0.00%↑ TSN 0.00%↑ ZBH 0.00%↑

2025-05-05: PM PLTR 0.00%↑ VRTX 0.00%↑ WMB 0.00%↑ CRH 0.00%↑ O 0.00%↑

2025-05-06: AM DUK 0.00%↑ BAM 0.00%↑ RACE 0.00%↑ TDG 0.00%↑ CEG 0.00%↑

2025-05-06: PM AMD 0.00%↑ ANET 0.00%↑ ET 0.00%↑ SU 0.00%↑ CPNG 0.00%↑

2025-05-07: AM NVO 0.00%↑ UBER 0.00%↑ DIS 0.00%↑ EMR 0.00%↑ JCI 0.00%↑

2025-05-07: PM ARM 0.00%↑ MELI 0.00%↑ APP 0.00%↑ DASH 0.00%↑ FTNT 0.00%↑

2025-05-08: AM SHOP 0.00%↑ BUD 0.00%↑ COP 0.00%↑ BN 0.00%↑ LNG 0.00%↑

2025-05-08: PM MCK 0.00%↑ MNST 0.00%↑ COIN 0.00%↑ NET 0.00%↑ WPM 0.00%↑

2025-05-09: AM ENB 0.00%↑ CCEP 0.00%↑ UI 0.00%↑ HMC 0.00%↑ PAA 0.00%↑

To add this FREE shared calendar, visit https://bit.ly/3ANoPtZ and click the ➕ "+" sign in the lower right corner. For iPhone, iPad, or any CalDAV device, don’t forget to enable iOS sync via https://calendar.google.com/calendar/u/0/syncselect