No One’s Bearish Anymore—That’s the Warning Sign

*The volume profile range was updated to reflect year-to-date data as of Jan 1, 2025 from Jan 1, 2024. As a result, the red Point of Control (POC) line has shifted higher.

Wall Street has entered full-risk-on mode.

From institutional giants to influential talking heads, the tone has turned decisively bullish. Some are calling this the start of a new golden era. Others are willing to look past growing risks—tariffs, a softening labor market—and projecting strength well into 2026.

But in markets, price drives the narrative, not the other way around. And when prices keep rising, almost everything gets spun as bullish.

Take these examples:

When forward 12-month S&P 500 EPS estimates are revised down, the narrative shifts to: “Earnings are bottoming.”

When analysts forecast just 4% earnings growth in Q2, bulls say: “That’s a low bar—upgrades are coming.”

One-Sided Headlines

This one-way optimism can start to feel like financial propaganda—where every datapoint, no matter how mixed, is interpreted as a reason to add more long exposure.

There’s little room for doubt, and even less for nuance. Sentiment, both online and in real-life conversations, is growing more euphoric by the day.

Dotcom Dreams Reignited

It’s becoming common to hear comparisons to 1998—before the blow-off top in 2000. The belief? “We’ll ride the wave and exit when things get crazy.” But market history doesn’t tend to reward that level of confidence.

As we see it, you only earn what you truly understand. Some may get lucky riding a mania, but over the long run, returns are dictated by knowledge, not luck.

Our Strategy from Here

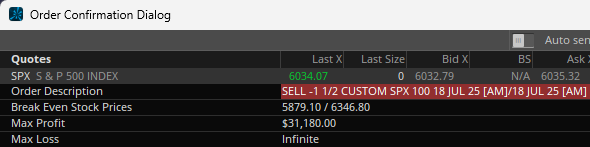

If the S&P 500 charges to 6,500 in the next few weeks—driven purely by momentum and narrative—we’re prepared to start locking in gains in a large way. At those levels, markets wouldn’t just be pricing in flawless execution for 2026, but likely baking in part of 2027 as well.

Let’s call it what it is: the U.S. has economically bullied the rest of the world. And yet the market is assuming that foreign trading partners will quietly absorb 100% of the tariff, that U.S. companies won’t see any margin compression, that consumers won’t feel the pinch, and that there will be no long-term consequences from flexing this kind of power. That’s a tall order—and a lot of optimism priced to perfection.

If we get that kind of spike, we’re considering selling long-dated, deeper in-the-money covered calls against our $SPY holdings and other positions we believe have become overvalued, or outright selling them.

To be clear: this isn’t an exit. Our positioning depends on the setup. We're still active—selling premium and selectively targeting entries with more favorable risk/reward dynamics, like the one we shared on X (Twitter) back on June 16.

What we’re not doing is chasing bubble logic. A 22x multiple on $300 EPS (a stretch already) gets you 6,600 on the S&P 500. Some are starting to talk about 30x dotcom multiples. That’s out of our knowledge domain.

To close, we’ll borrow a quote that continues to shape our approach during these uncertain—but exciting—times:

“What’s Your Game Plan?”

“Clearly, if we can keep up in good times and outperform in bad times, we'll have above-average results over full cycles with below-average volatility, and our clients will enjoy outperformance when others are suffering.”

— Howard Marks, September 5, 2003

SPX Quarterly OpEx and JPM’s Collar

S&P 500 Insider Activities

Growth Quality Dashboard (Rule of 40)

Earnings This Week

For the week of July 14, 2025, notable earnings releases for companies with a market cap above $2 billion include:

2025-07-14: AM FAST 0.00%↑

2025-07-14: PM FBK 0.00%↑

2025-07-15: AM JPM 0.00%↑ WFC 0.00%↑ BLK 0.00%↑ SCHW 0.00%↑ C 0.00%↑

2025-07-15: PM JBHT 0.00%↑ OMC 0.00%↑ PNFP 0.00%↑ SNDK 0.00%↑ HWC 0.00%↑

2025-07-16: AM JNJ 0.00%↑ BAC 0.00%↑ ASML 0.00%↑ MS 0.00%↑ GS 0.00%↑

2025-07-16: PM KMI 0.00%↑ CCI 0.00%↑ UAL 0.00%↑ REXR 0.00%↑ AA 0.00%↑

2025-07-17: AM TSM 0.00%↑ GE 0.00%↑ NVS 0.00%↑ ABT 0.00%↑ PEP 0.00%↑

2025-07-17: PM NFLX 0.00%↑ PPG 0.00%↑ IBKR 0.00%↑ WAL 0.00%↑ OZK 0.00%↑

2025-07-18: AM AXP 0.00%↑ HDB 0.00%↑ MMM 0.00%↑ SCCO 0.00%↑ TFC 0.00%↑

To add this FREE shared calendar, visit https://bit.ly/3ANoPtZ and click the ➕ "+" sign in the lower right corner. For iPhone, iPad, or any CalDAV device, don’t forget to enable iOS sync via https://calendar.google.com/calendar/u/0/syncselect