Forget April 2—There'll Be May 2, June 2, and Beyond

Markets fixate on short-term catalysts, but the bigger picture is what really matters

S&P 500 Holds 5600, but a 2020-Style V-Recovery Looks Unlikely

Bullish sentiment is growing as the S&P 500 repeatedly tests the 5600 level, with even former bears calling for a tradable bottom. While we remain neutral on direction, the JPMorgan collar structure is worth watching—specifically, the 6165 short calls and 5565 long puts. Historically, the index has gravitated toward one of these levels, breaching the long put strike in just 4 of the past 28 quarters. We don’t see conditions aligning for a drop anywhere near the 4700 short puts by the quarter end.

A sharp V-shaped rally to 6165 also appears remote, regardless of tariff developments. April 2 carries little immediate significance, with key decisions likely pushed to May, June, July or beyond. The geopolitical calculus is complex—no side wants to be the first to back down. In simple terms, if Mike Tyson corners you on the street, do you apologize outright or attempt to stand your ground when your girlfriend or wife is watching? The latter is the more likely scenario.

Why This Time Is Different

A 2020-style rebound looks unlikely—yes, the dreaded “this time is different” argument, but history supports caution. In 2008, rate cuts and even the introduction of QE failed to halt the decline; markets only stabilized when the Fed pledged more aggressive intervention. Today, rate cuts seem inevitable, but absent a crisis, QE is off the table. Meanwhile, long-term rates are unlikely to decline significantly given the government’s massive refinancing needs. Unlike 2020, when stimulus kept workers on payrolls, there’s no comparable cushion this time. The administration and the Fed may be orchestrating a controlled slowdown to push long-end yields lower, but it’s a delicate balancing act—one misstep could tip the economy into recession.

Positioning Ahead of Earnings

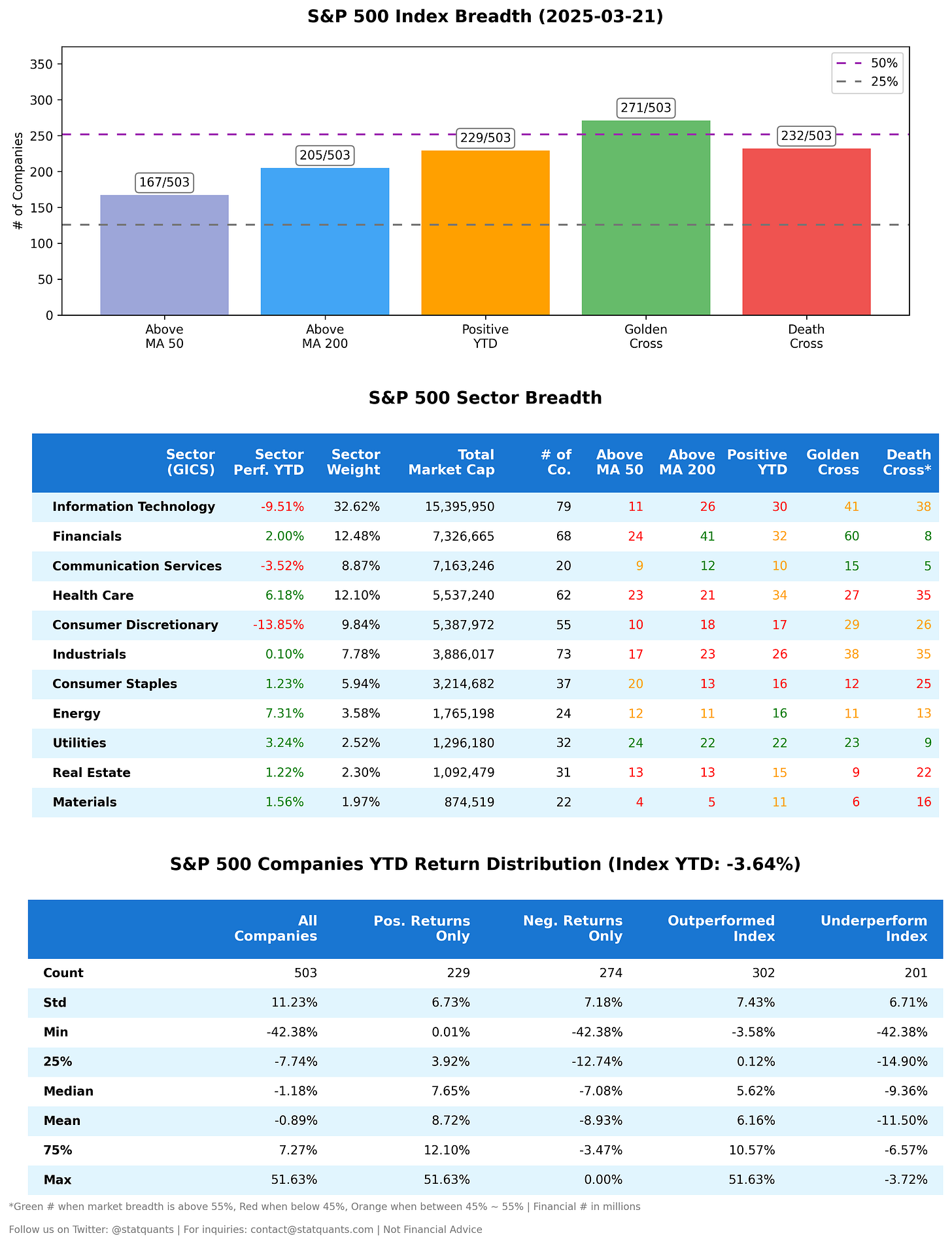

With earnings season approaching, it’s time to fine-tune portfolios. Despite some stabilization, the market remains bearish under the surface. Our positioning remains largely unchanged—we’ll consider long futures if the S&P 500 reaches 6000 by March 31, but that seems unlikely. For now, the best move is to let theta decay work, trim unwanted longs, add long-term hedges, and selectively build short exposure if conditions align. We see 5850 as the likely cap before quarter-end unless proven otherwise.

Wishing everyone a great trading week ahead—stay sharp.

Earnings This Week

For the week of Mar 24, 2025, notable earnings releases for companies with a market cap above $2 billion include:

2025-03-24: AM SBS 0.00%↑ PSLV 0.00%↑ KBH 0.00%↑ TBBB 0.00%↑

2025-03-24: PM OKLO 0.00%↑ EPAC 0.00%↑

2025-03-25: AM MKC 0.00%↑ GME 0.00%↑ CNM 0.00%↑ PONY 0.00%↑ CGON 0.00%↑

2025-03-26: AM CTAS 0.00%↑ PAYX 0.00%↑ DLTR 0.00%↑ CHWY 0.00%↑ JEF 0.00%↑

2025-03-26: PM ALVO 0.00%↑

2025-03-27: AM SNX 0.00%↑ WBA 0.00%↑ SOC 0.00%↑ CNTA 0.00%↑

2025-03-27: PM LULU 0.00%↑ BRZE 0.00%↑ AIR 0.00%↑

2025-03-28: AM TLK 0.00%↑

To add this FREE shared calendar, visit https://bit.ly/3ANoPtZ and click the ➕ "+" sign in the lower right corner. For iPhone, iPad, or any CalDAV device, don’t forget to enable iOS sync via https://calendar.google.com/calendar/u/0/syncselect