Algorithmic FOMO Ignites Bullish Patterns

It was another volatile week for the markets — despite the CBOE Volatility Index (/VX) trending lower, upside volatility is still volatility. The S&P 500 kicked off the week with a sharp 2.36% selloff on Monday, only to rebound 7.12% over the next four sessions. Sentiment shifted abruptly on a flurry of headlines:

Treasury Secretary Scott Bessent told investors in a closed-door meeting he expects a "very near" de-escalation in the US-China trade war.

Tesla CEO Elon Musk said his involvement in Dogecoin will "drop significantly" starting in May.

President Trump softened his rhetoric on tariffs on China, suggesting they would “come down substantially”.

While we strive to avoid political commentary, the current market dynamic leaves little choice. President Trump’s unpredictable messaging is moving asset prices in both directions. Although algo traders thrive on this environment, over time, such tactics risk eroding investor confidence and the premium global markets currently assign to US assets. A nation whose markets are hostage to headlines daily edges dangerously close to banana republic territory.

Technical Looking Strong

From a pure technical lens, the setup looks increasingly bullish. The S&P 500 closed Friday at 5,525.21, well above the 5,400 top end range we provided last week. Aggressive dip-buying — largely algorithmic — has broken the downtrend, reclaimed the all-time high anchored VWAP for SPY 549.75 (but not yet for the SPX 5,5571.21), and generated a series of popular bullish momentum signals.

With sellers largely exhausted, it won’t take much incremental buying to push the market higher, barring another destabilizing headline or tweet. Immediate technical targets include the 50- and 200-day moving averages — both within 3% reach. Latest positioning suggests a short-term cap around 5,750 and a support at 5,300, in line with current options positioning and pending major tech earnings next week, where 4 of the "Magnificent 7" will report.

Yet The Road Ahead Remains Fundamentally Shaky

The Q1 earnings season has been solid but unspectacular. While many companies met expectations, misses were punished severely — a sign of fragile sentiment. Tesla, always its own animal, surged 25% on the week despite once again missing estimates by a wide margin.

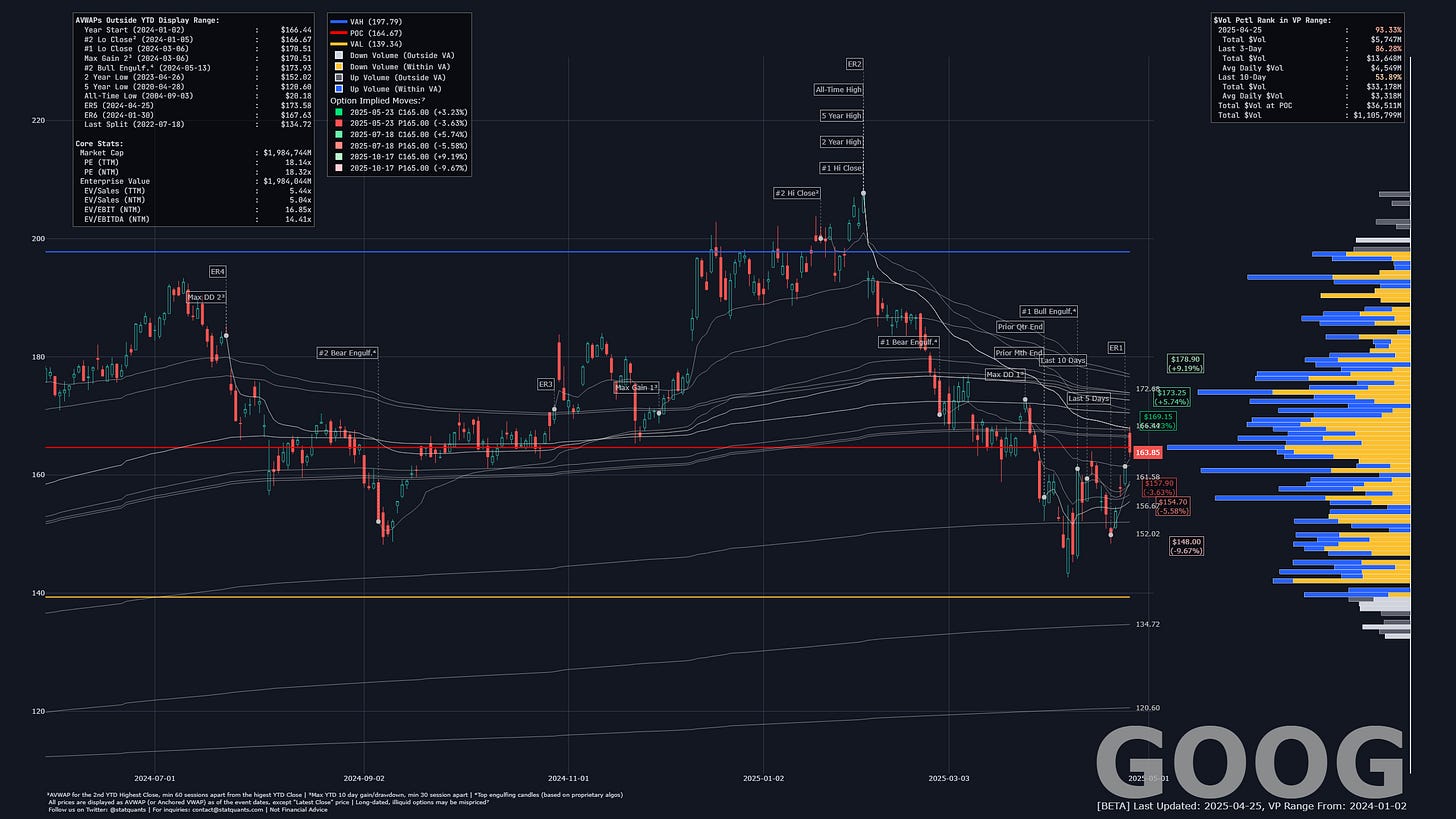

Investors are not chasing blindly. Take Alphabet: while it beat EPS estimates by nearly 40% ($2.81 vs. $2.01), roughly $0.65 of that beat came from unrealized gains on non-marketable equity securities (likely stakes in Anthropic, Databricks, and others). Alphabet also filed an automatic shelf registration — possibly setting the stage for major M&A activity after authorizing a 70 billion buyback. After an initial 5% pop, the stock gave back most of its gains, closing up just 1.47% on the day.

”OI&E of $11.2 billion for the three months ended March 31, 2025 included an $8.0 billion unrealized gain on our non-marketable equity securities related to our investment in a private company.”

The S&P 500 valuation remains stretched. At 5,525.21, the S&P 500 trades at 21x 2025 earnings and 18.4x 2026 earnings — lofty by historical standards given the backdrop. Investors must ask: does today’s macro and policy environment warrant an expansive premium multiple, particularly as risks mount?

Even before April’s chaos, foreign investors had begun trimming US exposure. Given recent events, it’s difficult to argue that confidence has improved. Risk management discussions are likely dominating investment committee meetings, rather than debates over buying dips as a "once-in-a-generation opportunity."

Structural Headwinds Persist

Three major catalysts are still missing to sustainably drive markets higher:

Aggressive policy support (e.g., Fed easing and fiscal stimulus)

Clarity on the upcoming $7+ trillion debt refinancing wave

Normalization of liquidity conditions

In our view, this is not a "sell everything" moment yet, but the erosion of confidence is real. The longer the market relies on breathless headline surges without fundamental follow-through, the more vulnerable it becomes — similar to a bank run where initial promise injections buy time, but they must eventually deliver.

The Federal Reserve's latest Financial Stability Report captured this risk succinctly:

"Despite this decline, equity prices remained high relative to forecasted earnings, which adjust more slowly than market prices."

April’s Damage Will Linger

Market weakness actually began after Q3 2024 earnings last November and re-accelerated following Q4 reports in February. The tariff drama only added fuel to the fire — it didn’t fundamentally change the trajectory.

Three weeks into the trade impasse with China, the real economic impact is starting to seep through. While many countries enjoy a temporary 90-day reprieve, US dependence on Chinese goods remains substantial. Delays in ordering for the holiday season (typically placed in early April) are a growing concern. Logistics lags — the Pacific Ocean doesn’t shrink to accommodate tariffs.

The longer this standoff persists, the more disruption will filter into earnings starting by late May and June. Retailers and consumers alike will feel the strain.

Meanwhile, the broader diplomatic fallout is deteriorating. Japan’s opposition leaders, notably Shinji Oguma, have openly condemned US actions as "American extortion." Allies are learning that time is on their side — the longer talks drag, the weaker President Trump’s hand becomes heading into the mid-term election season.

The underlying US demand isn’t merely around tariffs; it’s the audacious push for "free money" — foreign purchase of century-long Treasuries at zero interest under a so-called "Mar-a-Lago Accord." This vision mirrors the 1985 Plaza Accord, whose aftermath led to Japan’s "Lost Decade." It's little wonder the Japanese delegation emerged shell-shocked from negotiations.

Portfolio Actions

We took advantage of recent strength to trim some risk:

Closed portions of our lower-strike straddles but maintained the core 5,500 straddle position.

Trimmed our recently added Google shares.

Sold out of Meta following Alphabet’s earnings spike.

Alphabet, which traditionally does not provide forward guidance, was largely given a free pass by the market, with investors downplaying potential earnings downward revision for now. In contrast, Meta faces a projected $7 billion hit to ad revenue, according to the Street estimates, as digital ad spend from Temu and Shein comes under pressure.

President Trump’s daily claims of meetings with China — refuted daily by Beijing — suggest growing desperation rather than imminent resolution. Knowing his temperament, if China were truly lying, a retaliatory move escalation would have already materialized.

Bottom Line

The market may continue to levitate on headlines and technical momentum, but the April selloff inflicted real and lasting damage. Even if tariffs were to vanish overnight, global investors have seen enough to recognize the underlying U.S. agenda — and the hardline tactics are unlikely to quietly disappear. For experienced managers, this environment calls for caution, not euphoria.

In our view, equities tend to trend higher over time, but popular breadth indicators like the Zweig Breadth Thrust are largely irrelevant for today’s market. The reality is, only the Mag7 matter when it comes to meaningfully moving the S&P 500; 80% of the stocks are simply noise. A useful indicator should have flagged opportunities at 4,900 or 5,000, not at 5,500. If we had to simplify it, the most useful indicator would be: as long as the sun rises tomorrow, there's a 90% chance the S&P 500 will be higher 12 to 18 months later.

Earnings This Week

For the week of April 28, 2025, notable earnings releases for companies with a market cap above $2 billion include:

2025-04-28: AM ROP 0.00%↑ FMX 0.00%↑ DPZ 0.00%↑ RVTY 0.00%↑ PAC 0.00%↑

2025-04-28: PM WELL 0.00%↑ WM 0.00%↑ CDNS 0.00%↑ NXPI 0.00%↑ BRO 0.00%↑

2025-04-29: AM AZN 0.00%↑ KO 0.00%↑ NVS 0.00%↑ HSBC 0.00%↑ SPGI 0.00%↑

2025-04-29: PM V 0.00%↑ BKNG 0.00%↑ SBUX 0.00%↑ MDLZ 0.00%↑ OKE 0.00%↑

2025-04-30: AM CAT 0.00%↑ TTE 0.00%↑ ADP 0.00%↑ SAN 0.00%↑ UBS 0.00%↑

2025-04-30: PM MSFT 0.00%↑ META 0.00%↑ QCOM 0.00%↑ KLAC 0.00%↑ EQIX 0.00%↑

2025-05-01: AM LLY 0.00%↑ MA 0.00%↑ MCD 0.00%↑ LIN 0.00%↑ SHEL 0.00%↑

2025-05-01: PM AAPL 0.00%↑ AMZN 0.00%↑ AMGN 0.00%↑ SYK 0.00%↑ MSTR 0.00%↑

2025-05-02: AM XOM 0.00%↑ CVX 0.00%↑ ETN 0.00%↑ CI 0.00%↑ APO 0.00%↑

To add this FREE shared calendar, visit https://bit.ly/3ANoPtZ and click the ➕ "+" sign in the lower right corner. For iPhone, iPad, or any CalDAV device, don’t forget to enable iOS sync via https://calendar.google.com/calendar/u/0/syncselect