If You're Certain in Either Direction, You Might Be Missing Something

Avoid overconfidence—don't use leverage to gamble on your convictions

Market Overview

Deleveraging Short-Term Trades

Anyone who piled into Monday’s close expecting an easy ride to Thursday and a clean Friday exit just got a brutal lesson in market humility. The biggest losses rarely come from uncertainty—they come from overconfidence. If you’re levering up for short-term trades in either direction, it’s time to rethink. This isn’t the market to be a hero. At the very least, shift your time horizon out to the next 3–6 months.

Cut Through the Noise—Follow the Real Narrative

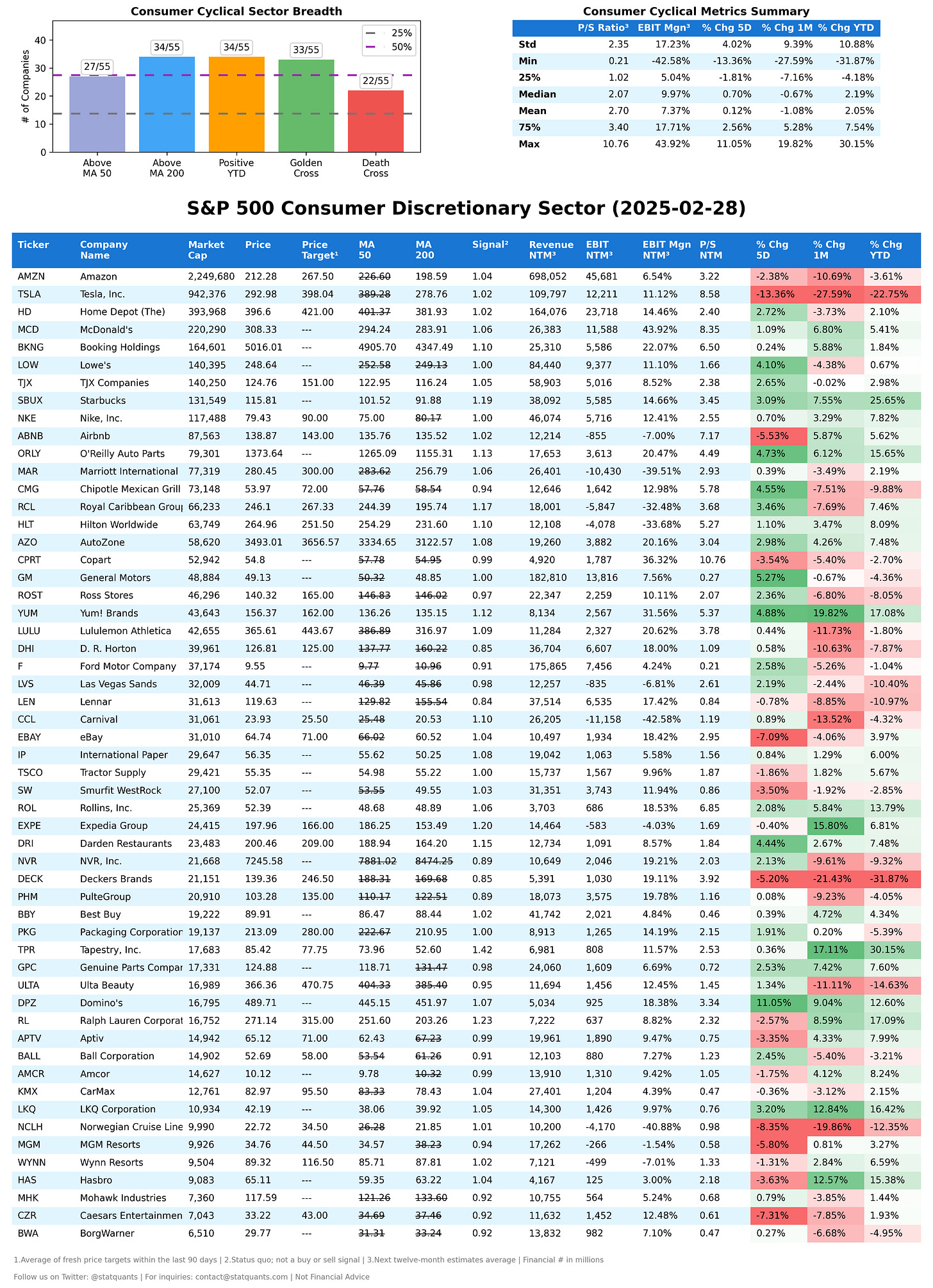

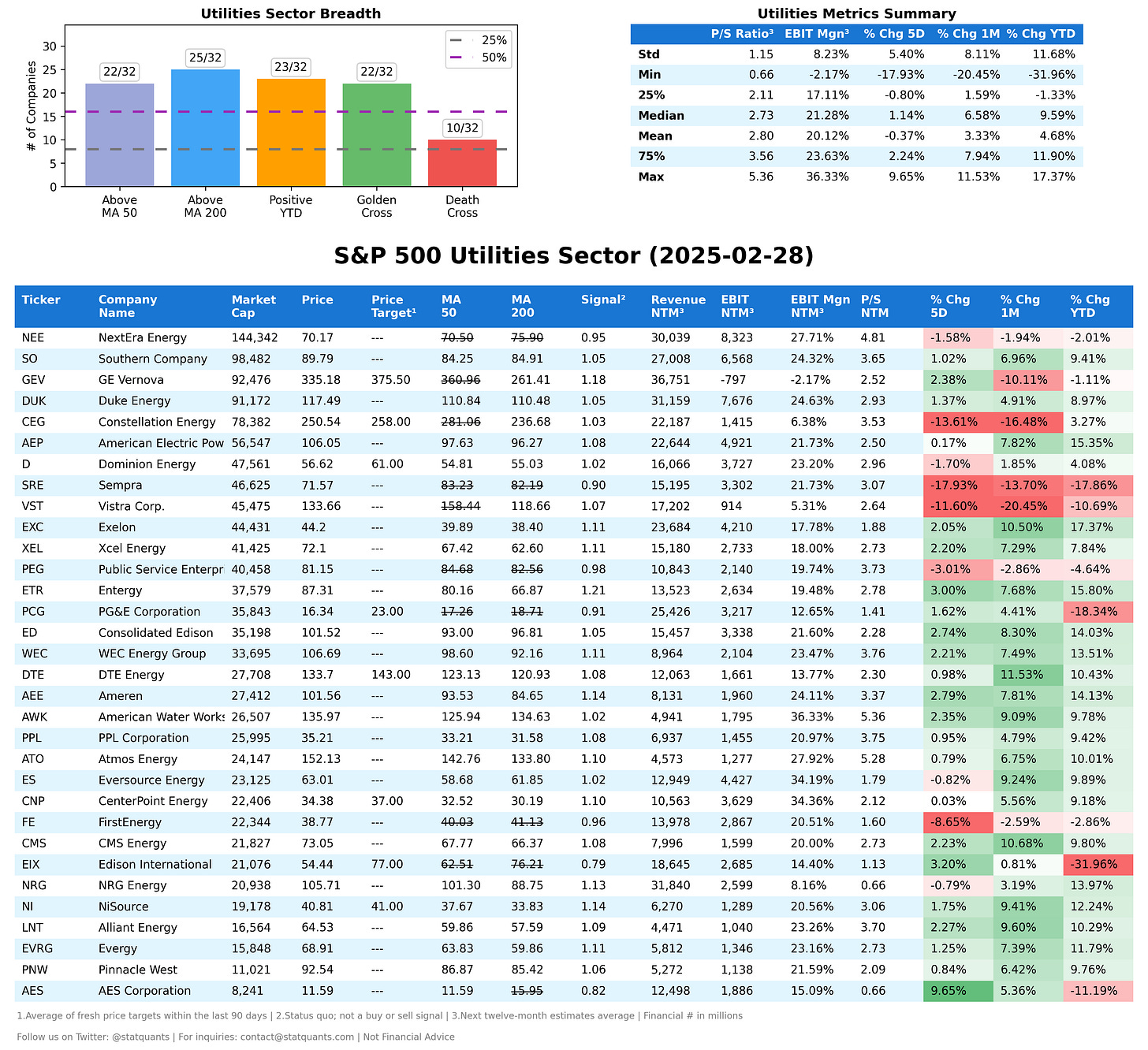

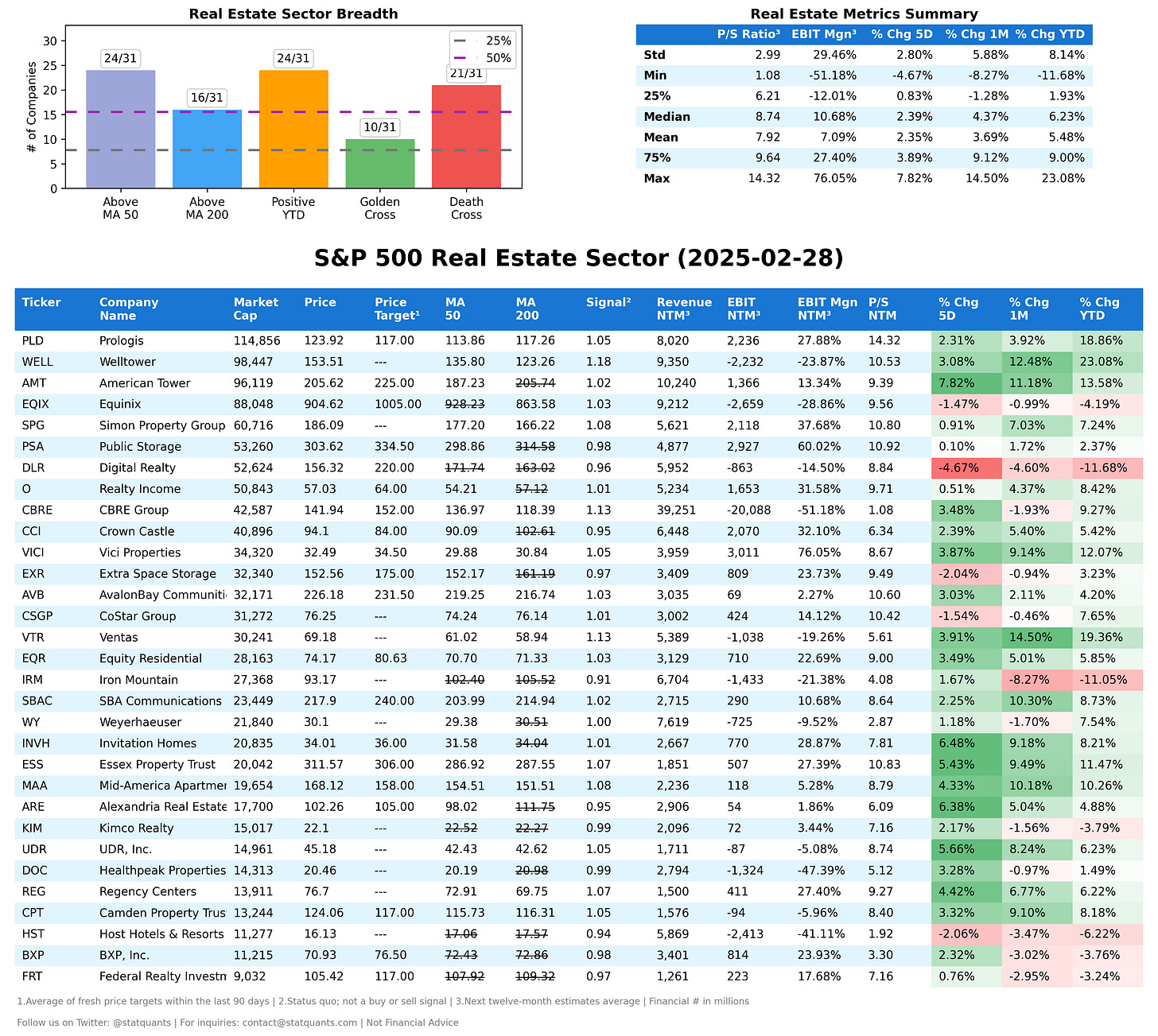

Right now, AI is the only theme strong enough to justify stretched valuations and momentum. The real question: Can the rest of the S&P 493 carry the torch if the Mag7 stumbles? We’re skeptical. While the Mag7 commands nosebleed multiples (only in market sentiment terms), the rest of the index isn’t exactly cheap—and lacks the same resilience in a weaker economy. The rotation thesis doesn’t convince us.

We don’t claim to know where the market goes next, but price action looks eerily similar to early 2020—when fundamentals were shaky, yet stocks kept grinding higher. Markets don’t have to make sense, but this setup offers poor risk/reward. To be clear, we’re not predicting a March 2020-style collapse—we just don’t see a compelling case for going aggressively long.

Positioning: Playing Defense

Right now, the market is hovering near the center of our straddles. We’re sitting tight unless we see a sharp move higher—think 6200 in the next two weeks—which would neutralize our hedges. When we saw four consecutive down days last week, we added upside protection. If we get another vertical move up, we’ll do the same on the downside.

Our bias remains slightly lower, with our straddle centered around 6000. But the bigger takeaway? The market is jittery—one sharp move can flip sentiment in either direction. If last week’s action caught you off guard, cut leverage now—before the market forces you to.

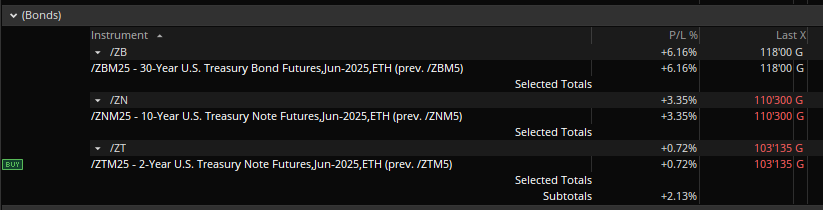

We’re also eyeing our bond positions—depending on how things unfold, we may start unwinding those as well.

Fun Fact

SPY 0.00%↑ $SPX Since 1929, the S&P 500 has only peaked in March twice—1937 and 2000. A rare occurrence, but the parallels to 2000 are also hard to ignore.

Earnings This Week

For the week of Mar 03, 2025, notable earnings releases for companies with a market cap above $2 billion include:

2025-03-03: AM TGTX 0.00%↑ TGS 0.00%↑ CRC 0.00%↑ BUR 0.00%↑ NOMD 0.00%↑

2025-03-03: PM OKTA 0.00%↑ GTLB 0.00%↑ ASTS 0.00%↑ ADMA 0.00%↑ CON 0.00%↑

2025-03-04: AM SE 0.00%↑ AZO 0.00%↑ TGT 0.00%↑ BBY 0.00%↑ ONON 0.00%↑

2025-03-04: PM CRWD 0.00%↑ FLUT 0.00%↑ ROST 0.00%↑ SQM 0.00%↑ CRDO 0.00%↑

2025-03-05: AM YPF 0.00%↑ CPB 0.00%↑ LOAR 0.00%↑ THO 0.00%↑ ANF 0.00%↑

2025-03-05: PM MRVL 0.00%↑ VEEV 0.00%↑ ZS 0.00%↑ MDB 0.00%↑ DSGX 0.00%↑

2025-03-06: AM JD 0.00%↑ CNQ 0.00%↑ HLN 0.00%↑ KR 0.00%↑ BURL 0.00%↑

2025-03-06: PM AVGO 0.00%↑ COST 0.00%↑ IOT 0.00%↑ HPE 0.00%↑ COO 0.00%↑

2025-03-07: AM AQN 0.00%↑

To add this FREE shared calendar, visit https://bit.ly/3ANoPtZ and click the ➕ "+" sign in the lower right corner. For iPhone, iPad, or any CalDAV device, don’t forget to enable iOS sync via https://calendar.google.com/calendar/u/0/syncselect