Markets Lose Steam – Nvidia’s Earnings the Last Hope

Mega-Caps Propel Stocks, but Momentum Wanes

Market Overview

Fool me once, shame on you, fool me twice shame on me. Will we see the familiar pattern of selling into Friday’s close and buying into Monday’s open once again? I bet many will be making such a move on Monday after the market opens.

For day traders, the market’s mood swings can feel like a psychological thriller. Unlike Kevin in Split (2016), who had 23 personalities, traders might feel lucky to juggle with just two—bullish for some days, bearish for some days, and sometimes during the same day multiple times.

The Market Is Struggling to Gain Momentum

It’s no surprise that the market’s upward momentum has slowed. After back-to-back 20%+ gains in the last two years, a lot of future growth has already been priced in. Since 2020, stock prices have outpaced forward earnings growth by a wide margin. The mega caps’ outsize Capex for this year is driving the bulk of future earnings growth expectations. Take Microsoft, for example—it’s committed $80 billion in CapEx spending this year while quietly scaling back its share buybacks. With FY 2024 net income at $88.14 billion, that’s almost 100% going toward Capex. Can Microsoft have its cake and eat it too?

Positioning for Uncertainty

Some subscribers have asked why we sound bearish all the time. It’s a fair question. In reality, we’re leaning defensive, not outright bearish. That doesn’t mean we dismiss the market’s ability to go higher—we’re simply positioning ourselves to profit whether the market climbs at a steady 30-degree angle (instead of 60-degree) or takes a more volatile path. We’re prepared to be wrong, and hopefully less wrong when we’re wrong.

Market sentiment is often anchored in confirmation bias. When stocks refuse to drop, bulls claim they can only go higher. When they stall, it’s seen as consolidation before the next leg up. The truth is, certainty in this business is the most dangerous. Our gut says we may see another big rally before any potential crash. Markets tend to move in ways that frustrate most people and cause the greatest financial pain for the massive.

Managing Risk and Exposure

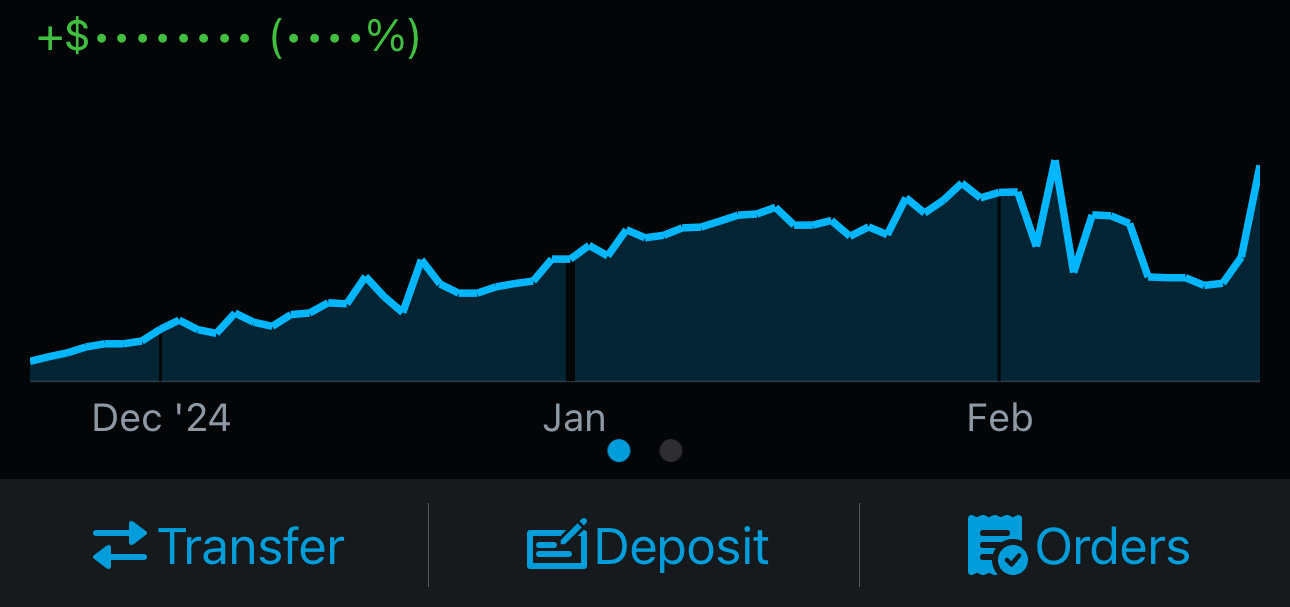

As we’ve shared in recent posts, we’ve been trimming long exposure on every pop, following Warren Buffett’s lead to increase our cash position. We’ve also been selling long-dated straddles around the 6,000 strike. So far, this strategy has played out well—our portfolio is back to the highs with the market barely down much, with the optionality to go defensive or offensive.

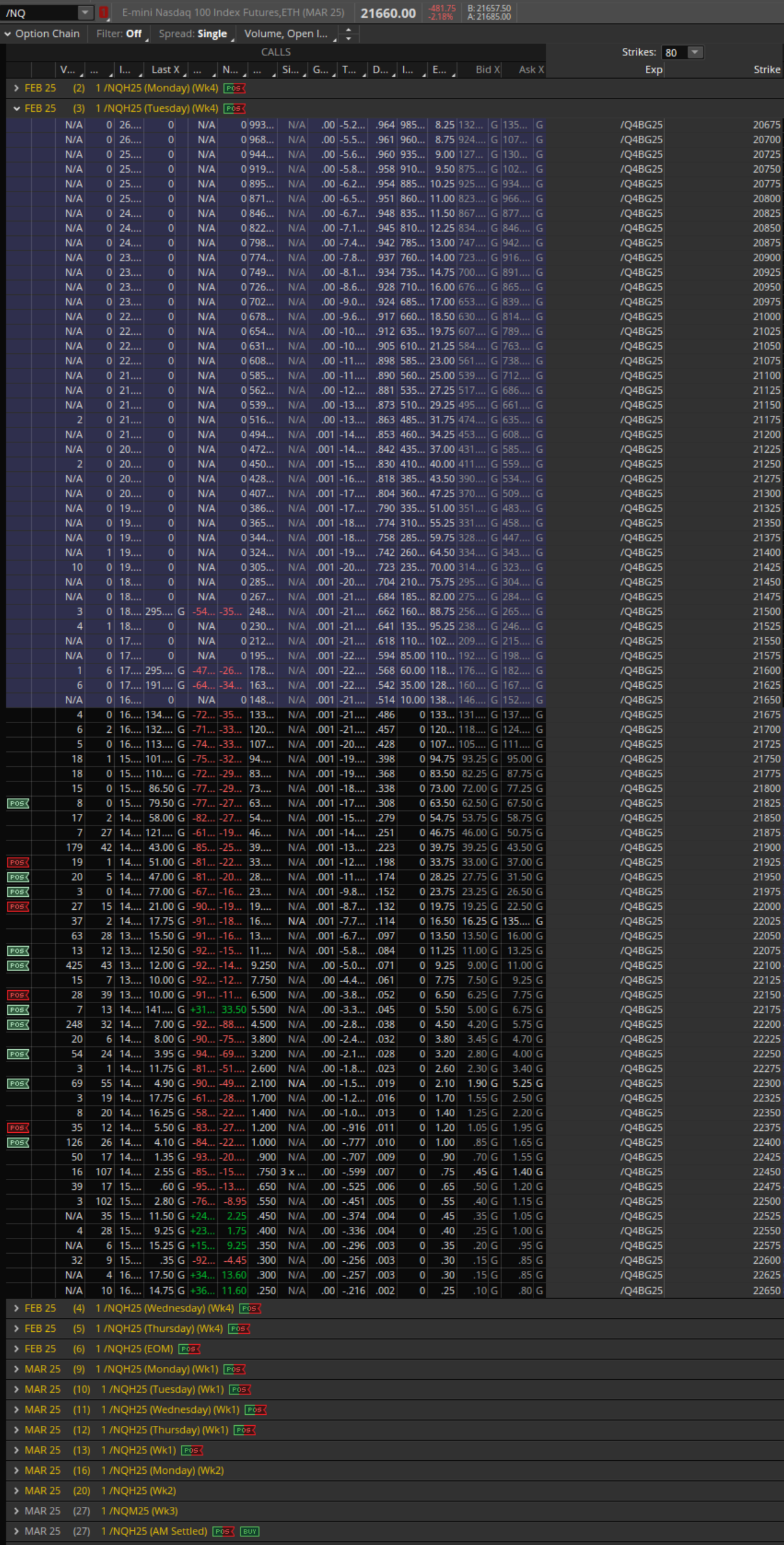

For instance, we hold many near-the-money leftover call hedges expiring in the next couple of weeks for /NQ futures. If there’s a sharp reversal next week, we’ll have the option to monetize these hedges or short a sizable number of futures contracts, depending on market conditions.

Economic Data: Noise vs. Signal

Economic data remains strong, but downside risks are growing. At StatQuants, we treat economic reports as short-term market movers rather than core decision-making tools. Many of these data points are headline noise, with revisions often ignored by the market. The quality and relevance of economic indicators are also questionable—take Core PCE, for example. Unless you’re homeless, stripping out rent, food, and energy makes little sense for real-world consumers. We live in reality, and we have reservations about how these metrics are framed.

What Should Be On Your Radar?

Japanese Government Bonds and Yen

Two major signals we’ve been watching are Japan’s 10-year bond yield and the yen. The yen carry trade didn’t vanish after last August in 2 days, and with inflation hitting 4.0%—its highest in decades—Japan may be forced to raise rates. If the yen continues to strengthen, this could have broad implications for the stock market.

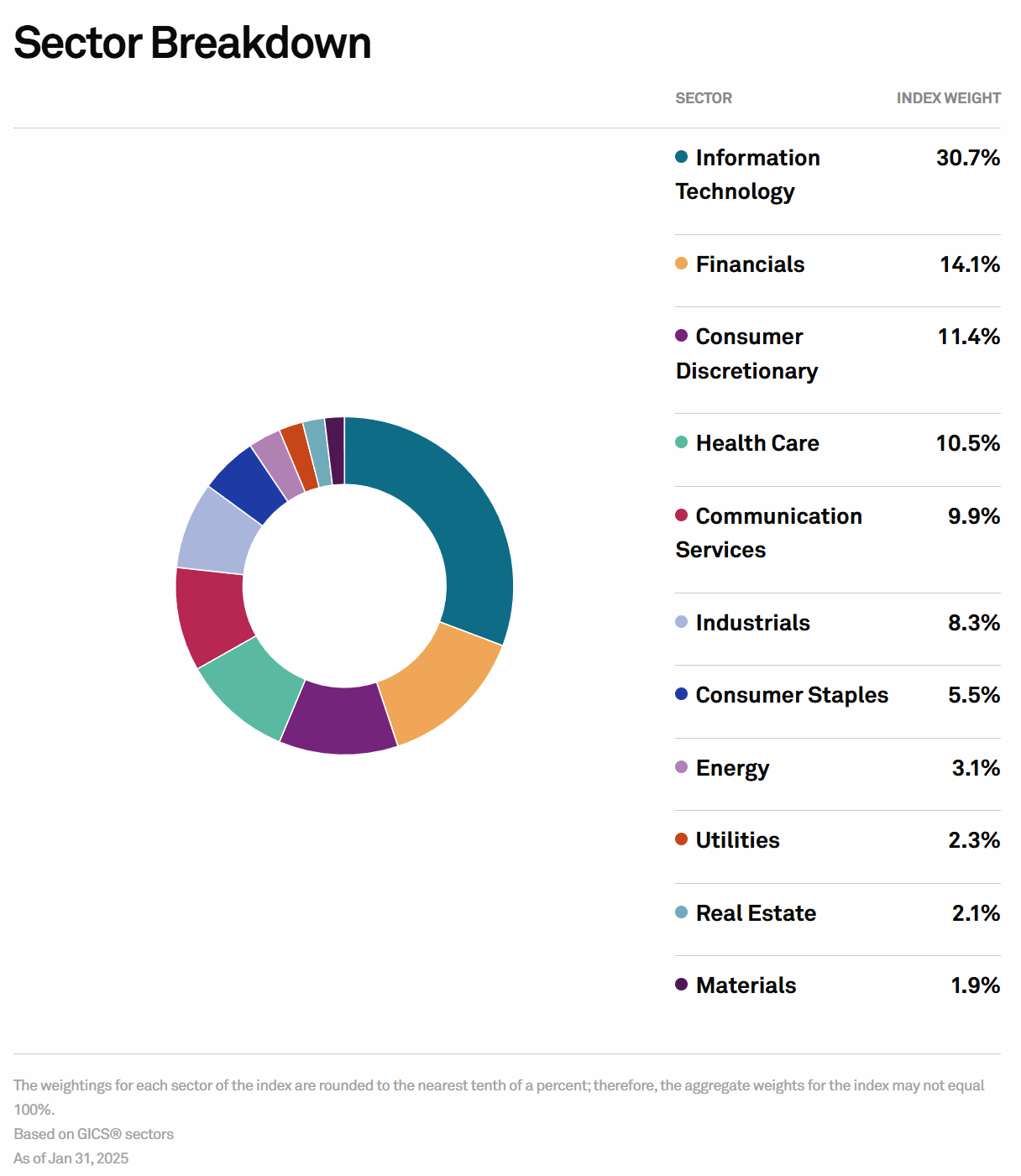

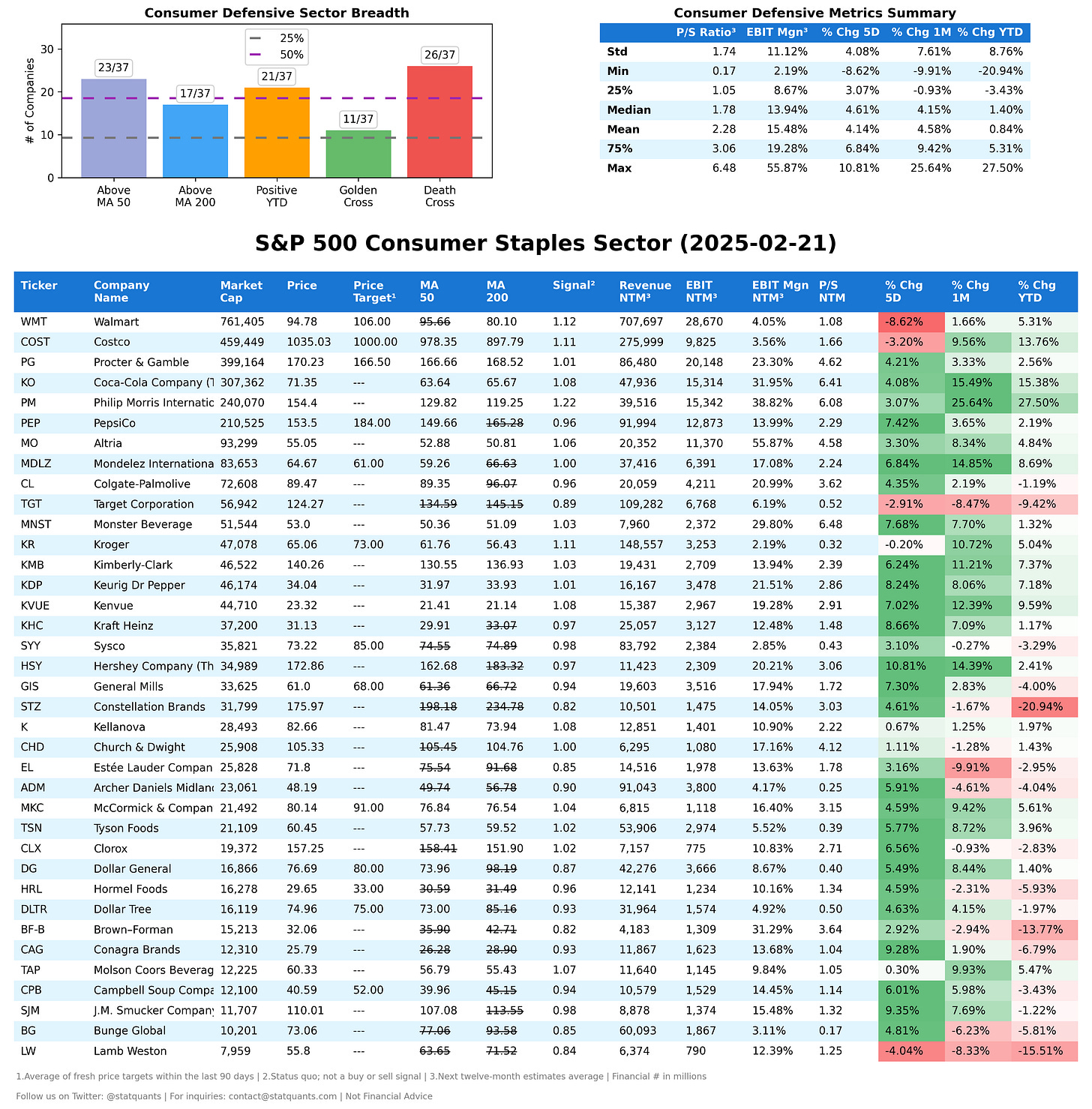

The Engine of the S&P 500

The Mag7 or Lag7, depending on how you view them—dominate the Tech, Consumer Discretionary, and Communication Services sectors, making up over 30% in the 7 alone or 50% of the sectors combined of the S&P 500’s total weight. Despite some struggles, the market remains just 2.18% off its all-time highs. Many of these stocks are battling their 50-day or 200-day moving averages fighting for their lives. Will Nvidia’s earnings next week revive the AI rally as it did before? No one knows.

Here’s what we do know:

Projected mega cap CapEx spending is already over $325 billion—how much of that flows to Nvidia and others?

Jensen Huang is the only mega-cap CEO not visibly aligned with Trump. Given Trump’s theatrical personality, it’s unusual for him not to capitalize on AI as a political talking point working closely with Jensen, the most important person in the AI world. If he’s silent, it could indicate that something potentially isn’t going too well at the moment.

Satya Nadella has toned down his enthusiasm for OpenAI, stating Microsoft is no longer compute-constrained and suggesting an 'overbuild' of AI infrastructure. He’s also dismissed AGI milestones as mere marketing. While not necessarily an actionable signal, it’s something we’ve taken note of and have approached with caution. Perhaps Microsoft is finally responding to investor concerns about ROI.

The market is at a crossroads again as it does all the time, and we’re positioned to navigate whichever direction it takes next — HOPEFULLY.

Earnings This Week

For the week of Feb 24, 2025, notable earnings releases for companies with a market cap above $2 billion include:

2025-02-24: AM WDAY 0.00%↑ ONC 0.00%↑ LI 0.00%↑ KSPI 0.00%↑ DPZ 0.00%↑

2025-02-24: PM OKE 0.00%↑ PSA 0.00%↑ O 0.00%↑ TCOM 0.00%↑ ZM 0.00%↑

2025-02-25: AM HD 0.00%↑ AMT 0.00%↑ BMO 0.00%↑ BNS 0.00%↑ SRE 0.00%↑

2025-02-25: PM INTU 0.00%↑ FANG 0.00%↑ CPNG 0.00%↑ ALC 0.00%↑ AXON 0.00%↑

2025-02-26: AM TJX 0.00%↑ LOW 0.00%↑ BUD 0.00%↑ VRSK 0.00%↑ STLA 0.00%↑

2025-02-26: PM NVDA 0.00%↑ CRM 0.00%↑ SNPS 0.00%↑ CRH 0.00%↑ SNOW 0.00%↑

2025-02-27: AM RY 0.00%↑ TD 0.00%↑ CM 0.00%↑ MNST 0.00%↑ VST 0.00%↑

2025-02-27: PM DELL 0.00%↑ ADSK 0.00%↑ LYV 0.00%↑ HPQ 0.00%↑ RKT 0.00%↑

2025-02-28: AM GTLS 0.00%↑ RDNT 0.00%↑ FRO 0.00%↑ AMRX 0.00%↑ APLS 0.00%↑

2025-02-28: PM EOG 0.00%↑

To add this FREE shared calendar, visit https://bit.ly/3ANoPtZ and click the ➕ "+" sign in the lower right corner. For iPhone, iPad, or any CalDAV device, don’t forget to enable iOS sync via https://calendar.google.com/calendar/u/0/syncselect