Moody's Ratings downgrades United States ratings to Aa1 from Aaa; changes outlook to stable

After Friday’s close, Moody’s cut the U.S. sovereign credit rating from Aaa to Aa1 and shifted the outlook to stable. This marks the last of the three major agencies to downgrade U.S. debt, following S&P’s move in 2011 and Fitch’s in 2023.

Reactions split fast across Fintwit: the bulls shrugged it off as irrelevant, arguing we’re heading to new highs regardless. The bears warned it could echo 2011, when the S&P downgrade sparked a sharp correction, or at least act as a catalyst for a short-term pullback.

We’re somewhere in the middle.

Back in 2011, the downgrade landed while the market was already fragile, emerging from the financial crisis. Now? The macro setup is different. The market is strong, liquidity has improved, and the cut was long anticipated. Most funds with AAA mandates likely adjusted their language years ago. A 3% dip wouldn’t surprise us—but it’d probably get bought the same day. If you're holding USD, Treasuries are still the safest, most liquid, and deepest market to park cash today.

The market’s been up for six straight weeks. A pullback wouldn’t be surprising, downgrade or not. Secretary Bessent and President Trump have fended off potential shorts with constant headline pumping. Without clear earnings or macro deterioration, it’s hard to see who’d go aggressively short—unless they know something the rest of us don’t.

Momentum Still Strong—But Stretched

From a technical standpoint, we’ve been saying the same thing for weeks: momentum remains strong, but stretched. Based on AVWAP, most market participants are in the green—people are playing with house money and see no reason and urgency to sell, especially with the "big beautiful bill" narrative in the air.

But this type of relentless strength cuts both ways. The higher we go without real progress—just vague deals and empty headlines—the more fragile the rally becomes at some points.

Consider the recent announcements:

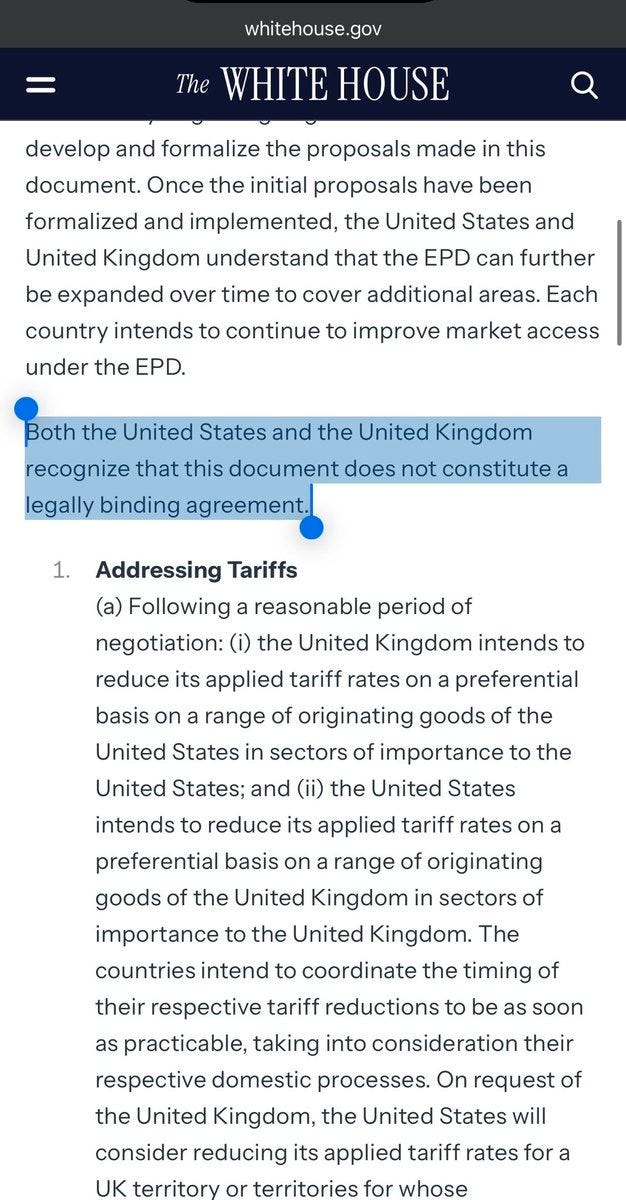

The UK "deal" was merely an agreement to continue discussions. Nothing serious and binding.

Qatar’s estimated 2025 GDP is $568B, yet we’re touting a $1.2T investment? These are long-term, vague pledges, not immediate capital flows.

Saudi Arabia’s 2025 GDP is estimated at $1.14T; the $600B “commitment” sounds big but remains aspirational.

The administration’s pivot from negativity in early April to optimism now is welcome. “Fake it until you make it” beats torching the place. But at some point, the market will want to see real results.

Strategic Decoupling: A Pause, Not a Reconciliation

The U.S. and China agreed to a 90-day truce to work on a strategic decoupling. This isn’t a resolution—it’s a timeout. The relationship resembles a fractured couple announcing an unplanned divorce, only to temporarily press pause to avoid upsetting the kids. Expect both sides to quietly reposition and prepare for the next phase.

This isn't just theory. Yesterday, China’s embassy in Argentina accused the U.S. of interfering in a yuan swap deal that supports Argentina’s foreign reserves. Tensions remain elevated, and the risk of escalation isn’t zero.

Powell: Dovish Short Term, Hawkish Long Game

At the Second Thomas Laubach Research Conference, Powell hinted the Fed may reframe its approach to balancing inflation and employment. He emphasized the importance of learning from the post-pandemic cycle—and left the door open for a near-term policy shift, possibly a rate cut post Jackson Hole.

Meanwhile, the Fed is preparing to ease capital requirements for banks—a supportive move for bond markets. But over the long haul, they’ll likely stay hawkish to anchor long-term yields.

Risk-Reward: Time to Reassess

If you got caught off guard in early April and are now back to green, or if you’ve been buying the dips successfully, it’s worth reassessing risk. From here, upside and downside seem about the same in the best case scenario—if not slightly skewed toward risk.

We’re seeing 6,600 price targets tossed around like confetti. Could it happen? Sure—technicals support it. At that level, the S&P would be trading at 22.15x 2026 forward earnings ($298 based on current projections), with 2024 actuals at $233 or 27% earnings growth for 2025.

Our “funnymental” model has the market back above its two standard deviation band, a zone that typically resolves with mean reversion—unless the “big beautiful bill” delivers a big stimulus.

Another theme we’ve been studying is the inflation tailwind for stocks in real terms. Looking globally, many major stock markets—and the long end of bond markets—are at or near all-time highs. With central banks stimulating across the board, markets are increasingly pricing in more borrowing and inflation. Both the CBO and Moody’s recent reports point to rising U.S. deficits: Moody’s expects the federal deficit to reach nearly 9% of GDP by 2035, up from 6.4% in 2024. In plain terms: earnings, revenues, and stock prices could rise in step with inflation and deficits.

Our Current Strategy

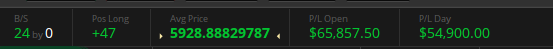

As noted in our previous post, we’re riding the momentum with flywheel option on futures and hedging selectively. Net-net, we’ve been making solid daily gains after offsetting the premium lost on our short delta positions.

That said, we noticed an unusually low appetite for hedging last week. So we picked up a few hundred short-dated puts for the next 5 days. If the Moody’s downgrade somehow triggers a pullback on Monday, those could pay off nicely. But we don’t expect that to be the case. If there is going to be a shakeout, we think it’s more likely to happen after Wednesday, once VIX expiration passes and optionality resets.

Last week’s rally didn’t stall at 5,800 within the expected range based on option positionings—it blew through 5,800 and closed at 5,958. That kind of strength makes it hard to bet aggressively against the trend short term, but it also raises the stakes if momentum starts to crack. As the old saying goes, “the price will take on the life of its own.”

S&P 500 Insider Activities

We’ve been accumulating shares of UnitedHealth during recent dips, with the expectation that revenue could be significantly impacted over the next year or two—potentially even cut in half. As we’ve said before, meaningful insider buying—especially relative to personal net worth—is a strong buy signal in our playbook.

We were pleased to see insiders stepping in after we initiated our position. That said, history shows that in these types of scenarios, stocks can still move lower even after insiders buy. We’re okay with that—and ready to add more if it happens.

Short-term traders often lack the patience to wait through a multi-year recovery in revenue or earnings, if one comes at all. But for us, this is a long-term investment—and we're comfortable holding through volatility.

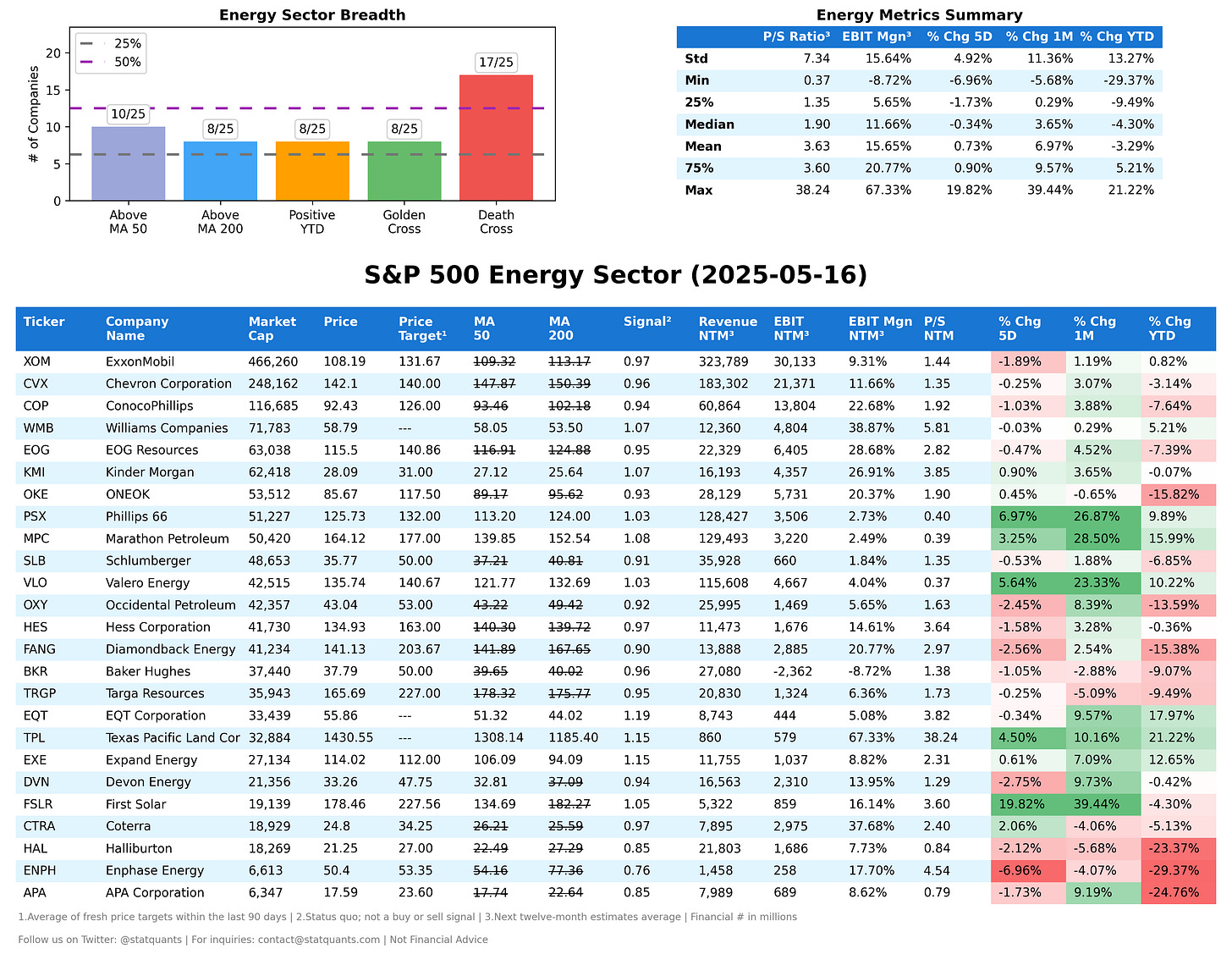

Growth Quality Dashboard (Rule of 40)

Earnings This Week

For the week of May 19, 2025, notable earnings releases for companies with a market cap above $2 billion include:

2025-05-19: AM ICL 0.00%↑ CRVL 0.00%↑ ZIM 0.00%↑ OXLC 0.00%↑

2025-05-19: PM TCOM 0.00%↑ QFIN 0.00%↑ AGYS 0.00%↑

2025-05-20: AM HD 0.00%↑ VIPS 0.00%↑ VOD 0.00%↑ VIK 0.00%↑ ESLT 0.00%↑

2025-05-20: PM PANW 0.00%↑ KEYS 0.00%↑ ZTO 0.00%↑ JHX 0.00%↑ TOL 0.00%↑

2025-05-21: AM TJX 0.00%↑ LOW 0.00%↑ MDT 0.00%↑ SMFG 0.00%↑ HLN 0.00%↑

2025-05-21: PM SNOW 0.00%↑ ZM 0.00%↑ URBN 0.00%↑ BBAR 0.00%↑ ENS 0.00%↑

2025-05-22: AM TD 0.00%↑ ADI 0.00%↑ DECK 0.00%↑ RL 0.00%↑ BJ 0.00%↑

2025-05-22: PM INTU 0.00%↑ WDAY 0.00%↑ ADSK 0.00%↑ CPRT 0.00%↑ ROST 0.00%↑

2025-05-23: AM BAH 0.00%↑ KT 0.00%↑ BKE 0.00%↑

To add this FREE shared calendar, visit https://bit.ly/3ANoPtZ and click the ➕ "+" sign in the lower right corner. For iPhone, iPad, or any CalDAV device, don’t forget to enable iOS sync via https://calendar.google.com/calendar/u/0/syncselect