The Market’s Already Living in 2026

Momentum dominates, but insiders, valuations, and fundamentals are quietly diverging

The Most Anticipated All-Time High — and the Fastest Rebound Ever

The S&P 500 hit a fresh all-time high last week — a milestone that felt inevitable given how quickly the market rebounded. According to Treasury Secretary Bessent, it marks the fastest recovery from a 15% decline in S&P history. For months, the debate wasn’t whether we’d reach a new high, but what would happen after. That debate seems to be fading fast as momentum surges and sentiment turns outright bullish.

Firms that were previously cautious are now calling for 6,500, even 6,800 by August or year-end. Several major Wall Street firms are scrambling to revise their price targets upward. Even Dan Niles — one of the more measured voices who correctly flagged the February correction — is advising investors not to fight the tape this summer, despite still warning about weakening macro data and demand pull-forwards later in the year.

To be clear, we’re not criticizing Dan or others. Flexibility is essential. The best investors know when to bend. You don’t fight the trend — and right now, the trend is screaming higher. When everyone’s making money, few are in a hurry to sell. It usually takes prolonged bad news to shift that psychology.

We weren’t bullish either. We've been running daily wheel options on futures and stated earlier that we’d buy aggressively above 6,000. We’ve now exercised some of those calls and added shares, viewing this as a trend shift — at least for the summer. We're not planning to chase further, but we are leaning slightly long via put-selling and other premium-focused options strategies. Everything looks bullish, but the valuations against the overall backdrop give us pause.

Eventually, valuations will matter — unless you believe that 23x forward earnings is the new floor, and the 99th percentile is the new normal.

When Valuation Stops Being a Joke

Valuation is a poor timing tool for the next 6–12 months, no doubt. Expensive stocks often get more expensive, sometimes for years. But that doesn’t mean you short into strength — especially not in today’s flow-driven market. Between corporate buybacks and passive 401(k) contributions, price-insensitive buying plays a large role. As long as people are employed, the S&P gets bid.

Still, it helps to understand where we stand.

Consensus bottom-up EPS estimates are around $265. With last Friday’s close at 6,173.07, the index is trading at 23.3x forward earnings. That’s within 5.3% of the mid-2026 targets from Morgan Stanley and Goldman Sachs — targets they just revised upward. If the current pace continues, we may hit them by late July. It’s worth noting: July has historically been one of the strongest months in recent years.

That said, these same firms were lowering their targets just three months ago — some down to 5,300 or lower. Funny how fast things change.

Our funnymental model — a framework we’ve used for 17 years — now shows the S&P once again above the 2-standard deviation band. It’s flashing the highest overvaluation signal we’ve seen since inception. The logic behind it is similar to Buffett’s GDP-to-market-cap model, GDP (revenue) vs. total public debt (pool of capital) as our proxy. If the current rally continues to 6800 in two months, it may break the model’s range for the first time in nearly two decades.

Signs of Rotation Beneath the Surface

In recent days, some of the more speculative high-fliers have started selling off, with capital rotating into more established mega-cap names. These aren’t retail flows — institutions are clearly behind the shift, and they’re not chasing blindly.

On Friday alone, PLTR 0.00%↑ dropped over 5% in the last 10 minutes of trading, finishing the day down 9.4%. CRCL 0.00%↑ tumbled 15.5% on the day and nearly 25% for the week.

Meanwhile, AMZN 0.00%↑ GOOG 0.00%↑ saw sharp reversals higher into the last 10 minutes of trading — again, classic signs of rotation by big players.

CRCL 0.00%↑ down 15.54% for the day and down 24.91% for the week.

While GOOG 0.00%↑ and AMZN 0.00%↑ saw the opposite in the final 10 mins of the day.

SPX Quarterly OpEx and JPM’s Collar

The upper bound of JPMorgan’s well-known quarterly collar looks to be somewhere north of 6,600. In strong bull markets, the S&P often gravitates toward this level. Historically, in 25 out of the last 32 quarters, the index breached the short call at least once. It closed above that level 18 of those 32 times.

Even in the quarters when it didn't breach, it got very close.

Unless the S&P drops over 279 points Monday, we’ll be adding to that stat — making it 26/32 (81.25%) breaches and 19/32 (59.38%) closes above the short call. This lines up with positioning data, suggesting most investors aren’t expecting a reversal until sometime in September — just around the time the next major Treasury X-date looms.

Maybe “flow” really is the most important thing now. And until that changes, the music keeps playing.

New Highs with Elevated VIX? Yes, It Happens

One common misconception: that the S&P 500 can’t reach all-time highs while the VIX is elevated. But history shows otherwise. We’ve previously shared charts demonstrating that numerous ATHs have occurred with the VIX in the mid-to-high teens — just like it is now.

Final Thoughts

It’s a tough market to trade right now — whether you’re bullish, bearish, or somewhere in between. Momentum is strong, psychology is even stronger, and news driven flows continue to prop things up.

Still, caution is warranted.

Valuations don’t matter… until they do.

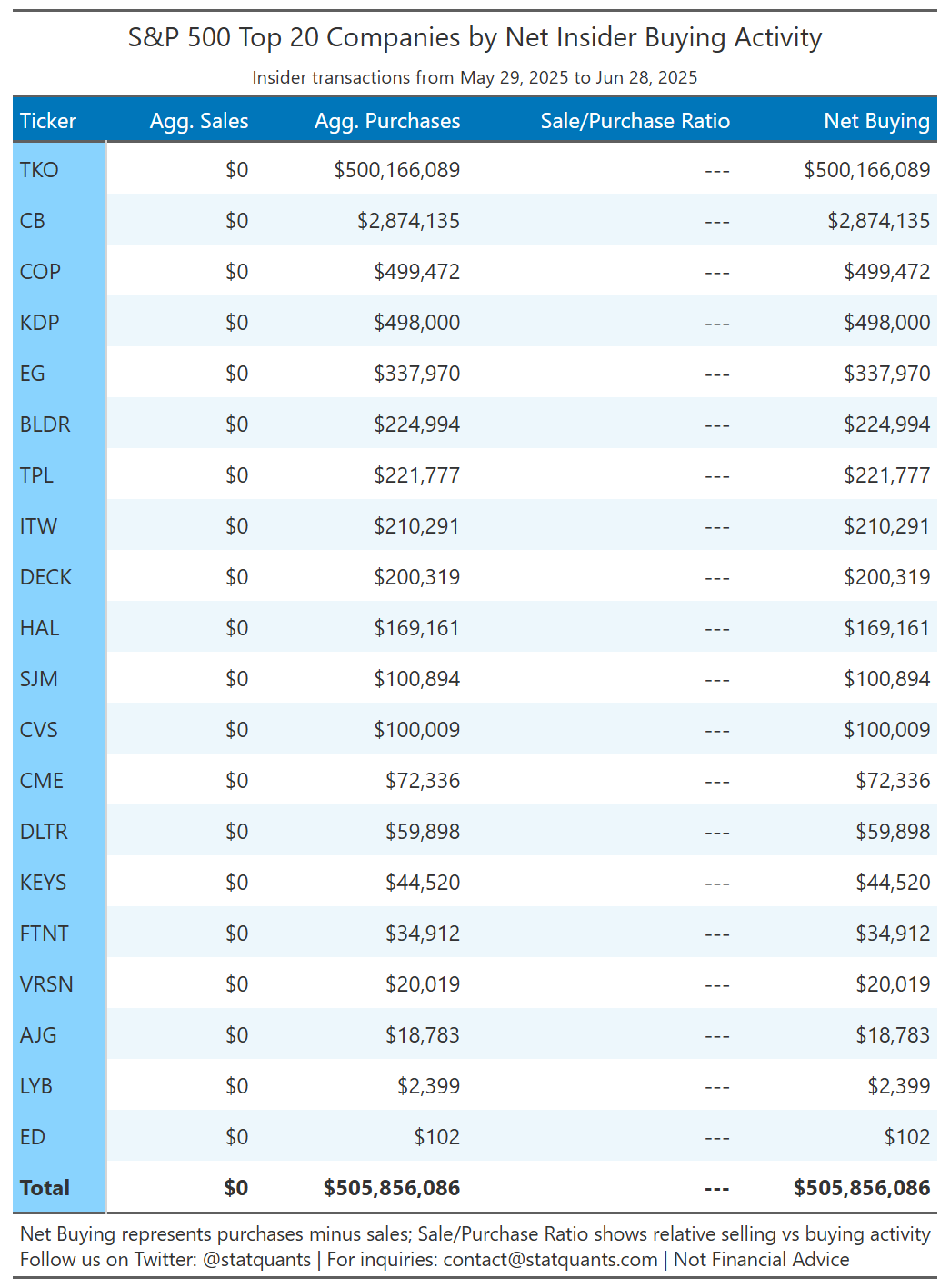

S&P 500 Insider Activities

Insider selling has picked up again at record pace — and historically, that tends to be a warning sign a few quarters ahead.

Growth Quality Dashboard (Rule of 40)

Earnings This Week

For the week of June 30, 2025, notable earnings releases for companies with a market cap above $2 billion include:

2025-06-30: PM PRGS 0.00%↑

2025-07-01: AM CIG 0.00%↑ MSM 0.00%↑

2025-07-01: PM STZ 0.00%↑

2025-07-02: AM HLN 0.00%↑ UNF 0.00%↑

To add this FREE shared calendar, visit https://bit.ly/3ANoPtZ and click the ➕ "+" sign in the lower right corner. For iPhone, iPad, or any CalDAV device, don’t forget to enable iOS sync via https://calendar.google.com/calendar/u/0/syncselect