Trade War Shock Mostly Priced In

The short-term shock from tariff headlines appears mostly behind us. Market behavior suggests traders now expect a policy backstop—what many are calling the “Trump Put”—around the 5,200 level. The administration’s reactions to market moves, particularly in equities and bonds, reinforce this perception.

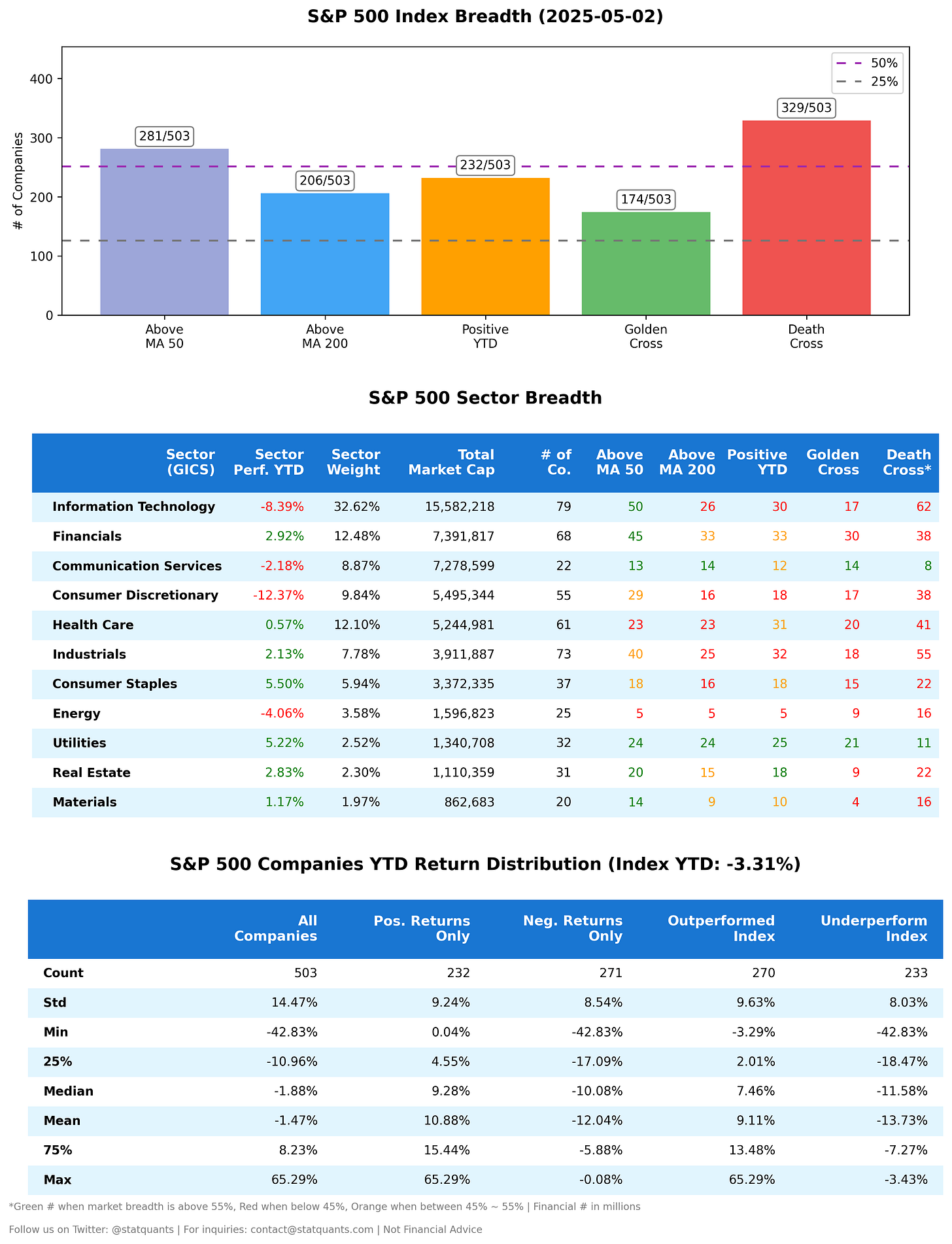

Current positioning and price action suggest traders are looking for short-term support near 5,500 and resistance around 5,800. Barring any major surprises, we expect the S&P 500 to drift toward the upper end of this range heading into options expiration on Friday, May 16.

Momentum Still Driving, but Vulnerable

Momentum and technicals continue to dominate in the short term—but the cracks are showing.

When there was no news on Monday and Tuesday, the market drifted lower. That changed abruptly at 3 PM PDT on Tuesday, when the U.S.-China meeting in Switzerland was announced. Futures spiked in thin overnight trading, only to give up gains by the next day’s close.

The same pattern repeated after President Trump announced a tariff framework with the UK at 6 PM PDT on May 7. The market jumped, then faded as investors realized the deal was more symbolic than substantial. Even Trump’s direct call to “go out and buy stock now” only created a fleeting lift that sold off by the close.

Friday followed the same script: rumors of a potential China tariff pause sparked buying, which quickly lost steam. A real breakthrough on China could push the index decisively through 5,800, but unserious tweet rallies have struggled to hold starting at this level.

The durability of any headline bounce remains in question.

Where We Stand

While we do think some kind of tariff pause may happen eventually, we’re not betting on it this coming week. If it does happen sooner, it would suggest the White House feels pressured to calm markets—which could complicate the rest of its policy agenda. Tax cut extension or removing other taxes requires a new funding source.

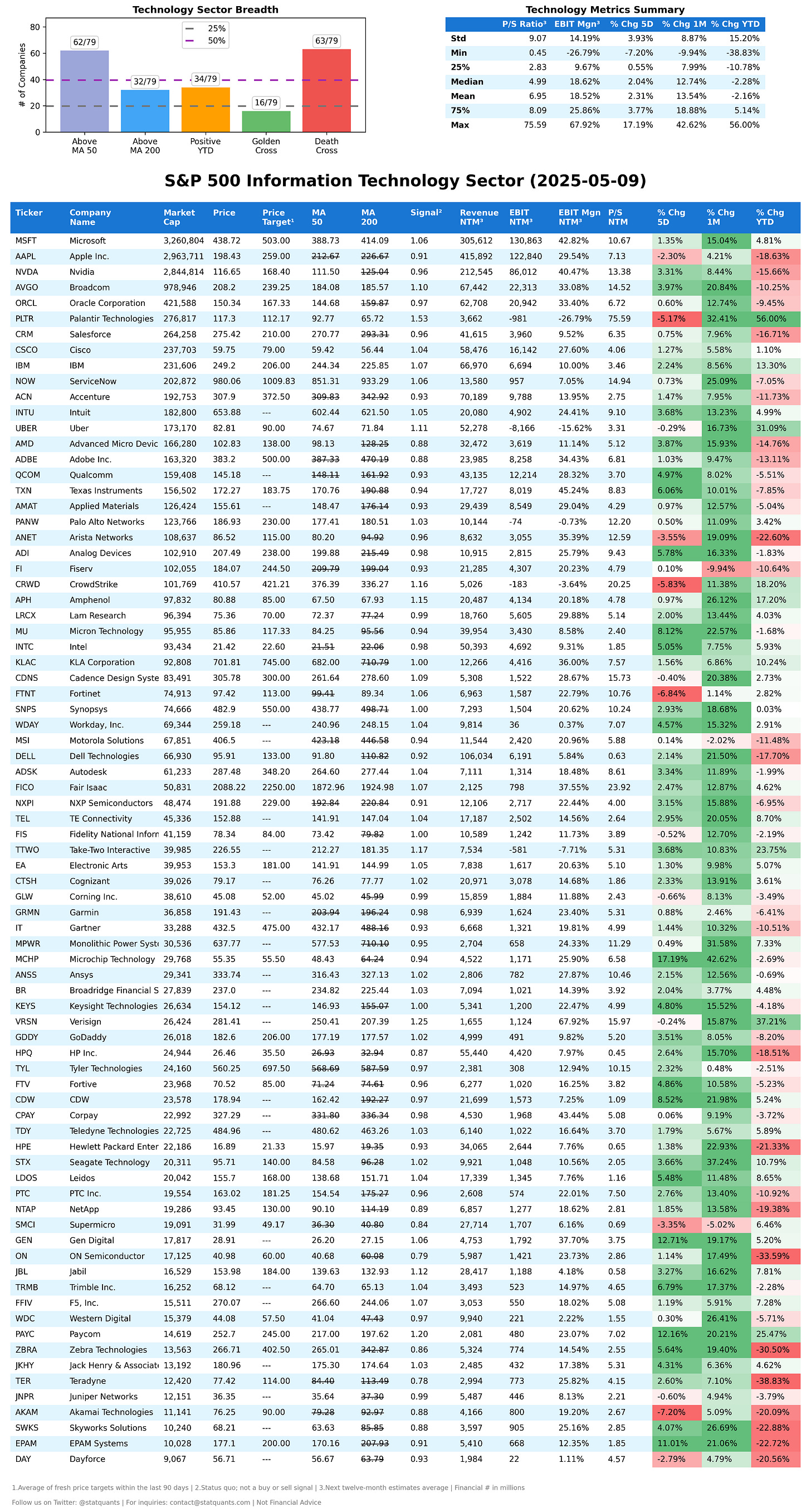

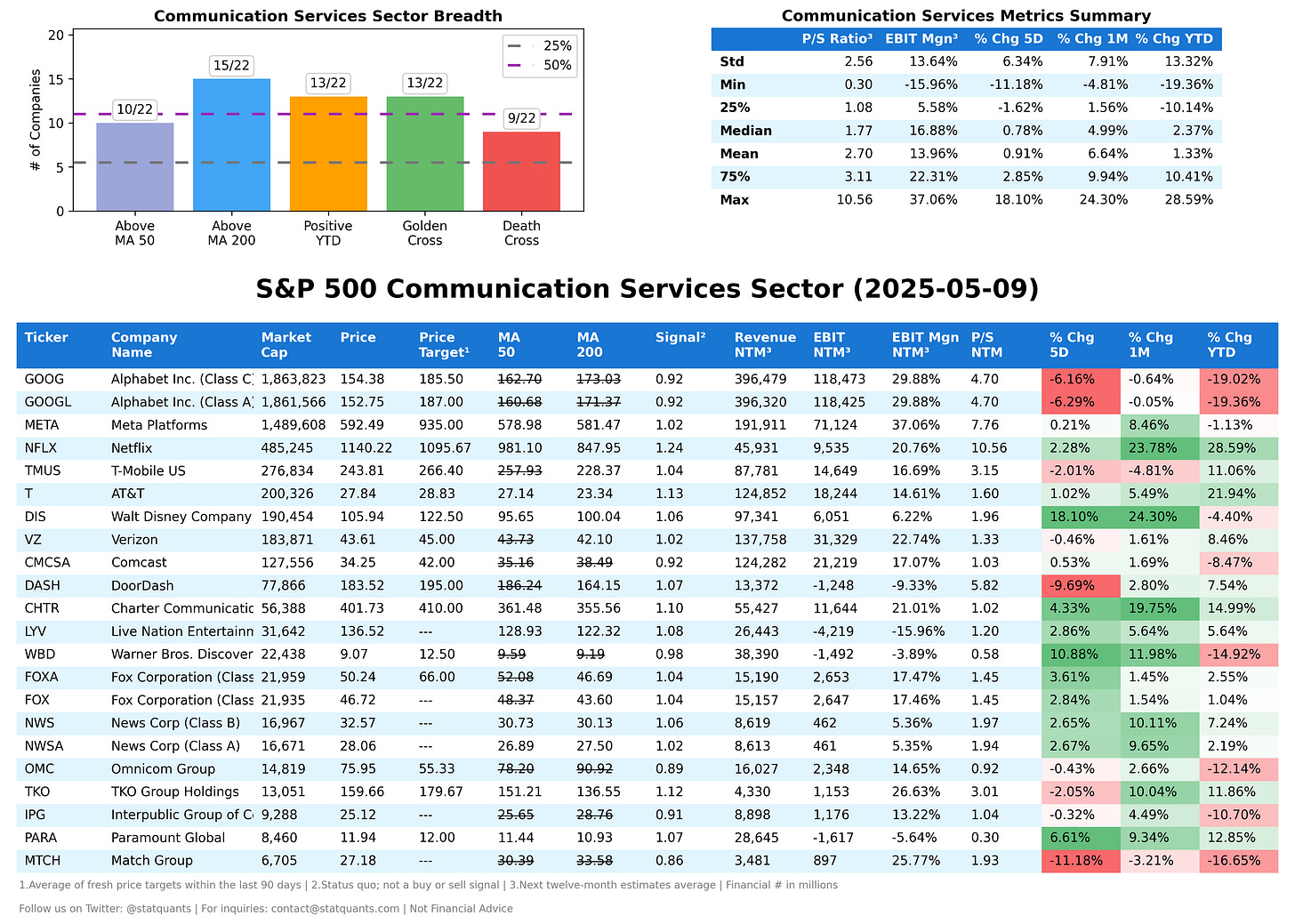

We believe most short covering has already played out, and any sustained rally now needs new, long-term capital. But given current valuations, uneven growth prospects, and elevated uncertainty, we don’t see this as a full risk-on environment.

Soft and hard economic data will likely remain mixed. Any slowdown will be rationalized—explained away with “pull-forward” effects or temporary weakness—with hopes that growth reaccelerates later in the year.

Inventory Panic Might be Overblown

Fears of empty shelves and critical shortages are likely overstated. Trade hasn’t stopped. Both the U.S. and China have quietly granted waivers and tariff rebates, and many Chinese shipments were redirected through other countries. Consumers may face less product variety and some price bumps, but we don’t see a lasting supply crisis.

Trade data shows U.S. companies built record inventory ahead of the tariffs. Any resulting inflation may arrive later—and more slowly—than many expect.

A New Kind of Risk

As markets rise, there's also a political feedback loop: the more the market climbs, the more emboldened President Trump becomes to talk tough again. That means more headline risk.

While these sudden pops keep short sellers wary, a true market breakdown would likely require real weakness—visible in data or earnings, before the shorts reenter aggressively.

Whether or not we get a formal recession in 2025, we expect a slowdown. Stocks can rebound in a V-shape. Businesses can’t. A factory decision made today takes months to plan and finance. Tariff flip-flops make that process even harder—especially if the factory still depends on imported parts.

If tariffs are later rolled back, those factories may no longer make economic sense. That kind of damage can’t be undone as quickly as a stock chart; even businesses just stay on hold without making decisions.

Advice to Investors

Avoid chasing headlines. Focus on companies led by teams that know how to operate in uncertainty. If Trump-induced volatility bothers you, brace yourself: it’s probably not going away for the next 3.5 years.

During Trump’s first term, the S&P 500 oscillated between 14x and 18x forward earnings, eventually peaking at 23x post-COVID stimulus. Today’s rally has come largely from overnight gaps, not sustained daytime buying. That’s not the kind of strength long-term capital trusts. The foundation feels more like a sandcastle than bedrock.

Trump could have 3.5 more years, 2 if he loses the midterms, or—worst-case for those seeking stability—7.5 more if he somehow gets a third term. Regardless, quality companies bought at reasonable prices should outlast him.

Investors shouldn’t let headlines or daily price swings derail their long-term plans. The political landscape on both sides has been disappointing, and there’s little reason to expect meaningful improvement soon. Stay focused.

Our Current Strategy

We’re holding most of our straddles initiated in Q4 2024. At 21.68x forward earnings on $261.04 EPS, the market still looks expensive. In fact, it’s more expensive now than at the start of the year—as analysts continue cutting second-half earnings estimates.

In the short term, we’re running daily “flywheel” options on futures: selling covered calls and puts against our positions to get extra yield or funding 5 delta hedges. We don’t plan to buy shares aggressively to hedge upside risk unless the S&P hits 6,000—we have the luxury to be patient.

Long term, we’re waiting for better entry points while collecting theta. The fact that Warren Buffett didn’t deploy much capital in April reinforces our view. We also monitor insider buying activity closely, and right now, we’re seeing way more selling than buying — especially when adjusted for their net worth.

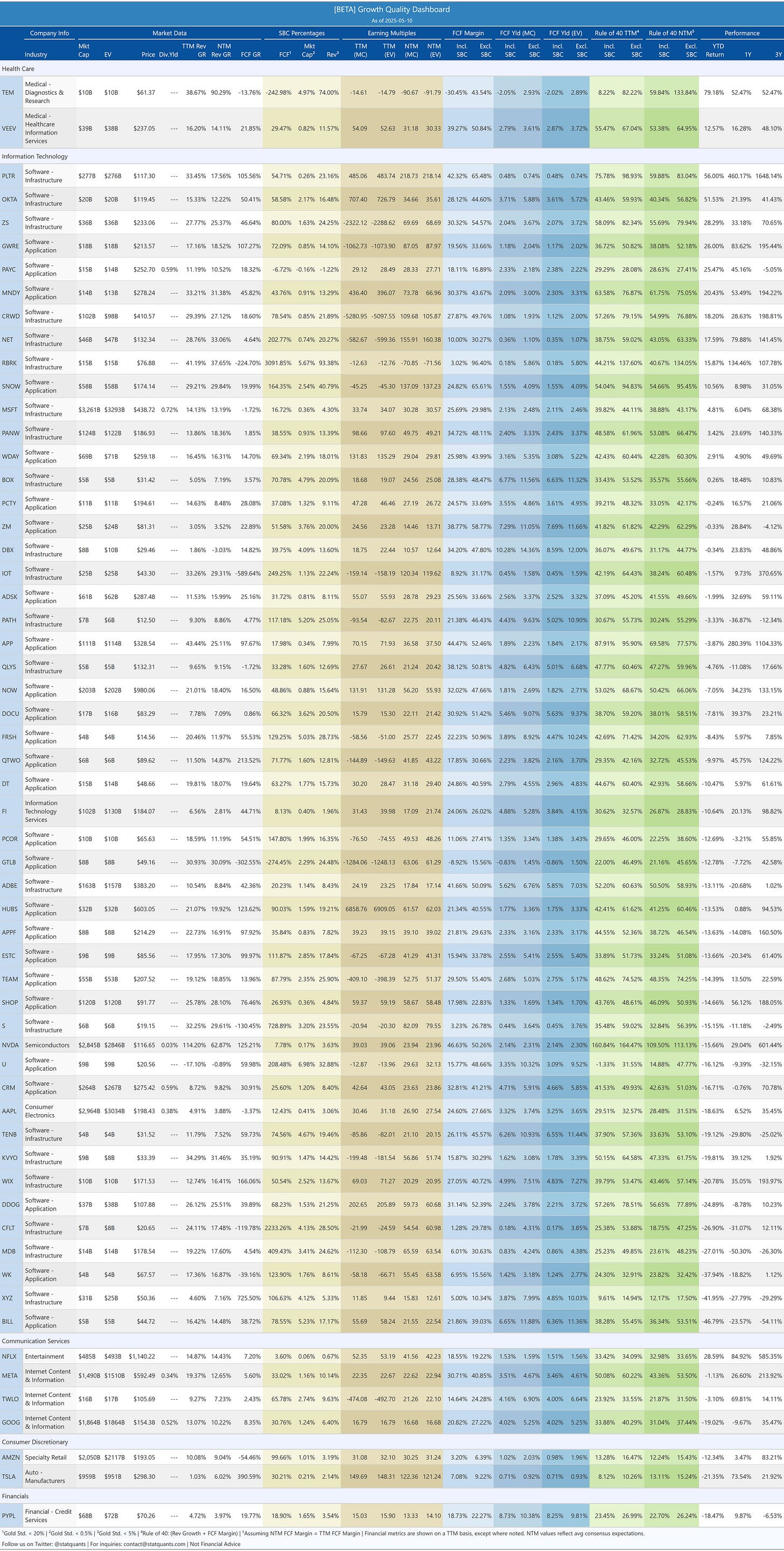

Rule of 40

Earnings This Week

For the week of May 12, 2025, notable earnings releases for companies with a market cap above $2 billion include:

2025-05-12: AM PBR 0.00%↑ FER 0.00%↑ NRG 0.00%↑ FOX 0.00%↑ KSPI 0.00%↑

2025-05-12: PM SPG 0.00%↑ SBS 0.00%↑ DVA 0.00%↑ ACHR 0.00%↑ BCO 0.00%↑

2025-05-13: AM SONY 0.00%↑ SE 0.00%↑ NU 0.00%↑ JD 0.00%↑ VOD 0.00%↑

2025-05-13: PM ALC 0.00%↑ EXEL 0.00%↑ CAE 0.00%↑ KRMN 0.00%↑ LSTR 0.00%↑

2025-05-14: AM TM 0.00%↑ DDI 0.00%↑ MMYT 0.00%↑ VFS 0.00%↑ SKM 0.00%↑

2025-05-14: PM CSCO 0.00%↑ STE 0.00%↑ STN 0.00%↑ NXT 0.00%↑ BOOT 0.00%↑

2025-05-15: AM WMT 0.00%↑ BABA 0.00%↑ DE 0.00%↑ NGG 0.00%↑ NTES 0.00%↑

2025-05-15: PM AMAT 0.00%↑ TTWO 0.00%↑ BAP 0.00%↑ DOCS 0.00%↑ SOBO 0.00%↑

2025-05-16: AM RBC 0.00%↑ FLO 0.00%↑ BRC 0.00%↑ RLX 0.00%↑

To add this FREE shared calendar, visit https://bit.ly/3ANoPtZ and click the ➕ "+" sign in the lower right corner. For iPhone, iPad, or any CalDAV device, don’t forget to enable iOS sync via https://calendar.google.com/calendar/u/0/syncselect