A TACO a Day: When FOMO Pays (Until It Doesn’t)

Markets are hooked on the TACO trade—Trump Always Chickens Out. Every time there's a negative headline around trade tensions, the dip gets bought faster and recovers more quickly. So far, betting on the bounce has worked. But like the once-popular "short VIX for free money" trade, this too will stop working eventually. When that happens, it won’t be pretty.

Price Action Has Changed the Narrative

There’s a timeless saying: "Nothing changes sentiment like price." After a few strong weeks, even many bears have thrown in the towel, admitting we’re likely headed for new all-time highs before any potential downturn. The conviction is less about bullish euphoria and more about a growing belief that downside risk is limited. Very few think we’ll revisit April’s lows.

This moment feels eerily similar to July 2007, even as the subprime crisis worsened, when then-Citi CEO Chuck Prince famously said:

"As long as the music is playing, you've got to get up and dance. We're still dancing."

Fast forward to today: investors are mocking the likes of Ray Dalio, Jamie Dimon, and even Warren Buffett for sitting out or warning of risks that haven’t materialized. Buffett’s record cash pile missed the April low. Dalio and Dimon have been “wrong” for over a decade, yet Dimon continues to run the most successful bank in the world, and markets rush into JPMorgan whenever there’s real trouble (see: SVB).

The market has counted the people confidently calling for new all-time highs instead of urging caution, and the combined capital they manage doesn’t come anywhere close to what Buffett, Dalio, or Dimon oversee. That’s not just trivia. It’s perspective.

Just because danger hasn’t shown up yet doesn’t mean it no longer exists. In fact, the real risk may be that no one believes risk exists anymore.

SPX Quarterly OpEx and JPM’s Collar: Breaking the Pattern

Attention now shifts to the June 20th Quarterly OpEx and JPMorgan’s collar levels heading into quarter-end. Despite expectations for post-May OpEx weakness, the market has held up remarkably well, down less than 1% over the past two weeks, with momentum still running hot beneath the surface.

What we’re seeing in SPX is highly unusual. In prior quarters, when the index dropped deep into JPM’s long put zone early in the cycle, it never managed to climb back toward the short call level. This time? Not only did SPX touch that upper band, but it also broke above it and held the line all week. That’s a notable shift in behavior, and one we’re watching closely.

Stay Patient, Stay Nimble

We expect more chops in the near term, around 5,800 to 6,000. Post-OpEx positioning have shifted toward the 6,250 strike, and positioning remains skewed bullish. But in a headline-driven market, no model is particularly reliable including ours.

Remember the Goldman Sachs clip we shared last week? Even as they recommended fading the rally, they still suggested buying the 6,100 July calls. That’s a valid strategy—two things can be true at once.

So we’ll keep playing the flywheel on futures—a setup that pairs well with our existing positioning. Until something meaningful shifts, patience and tactical execution remain our favor.

S&P 500 Insider Activities

Growth Quality Dashboard (Rule of 40)

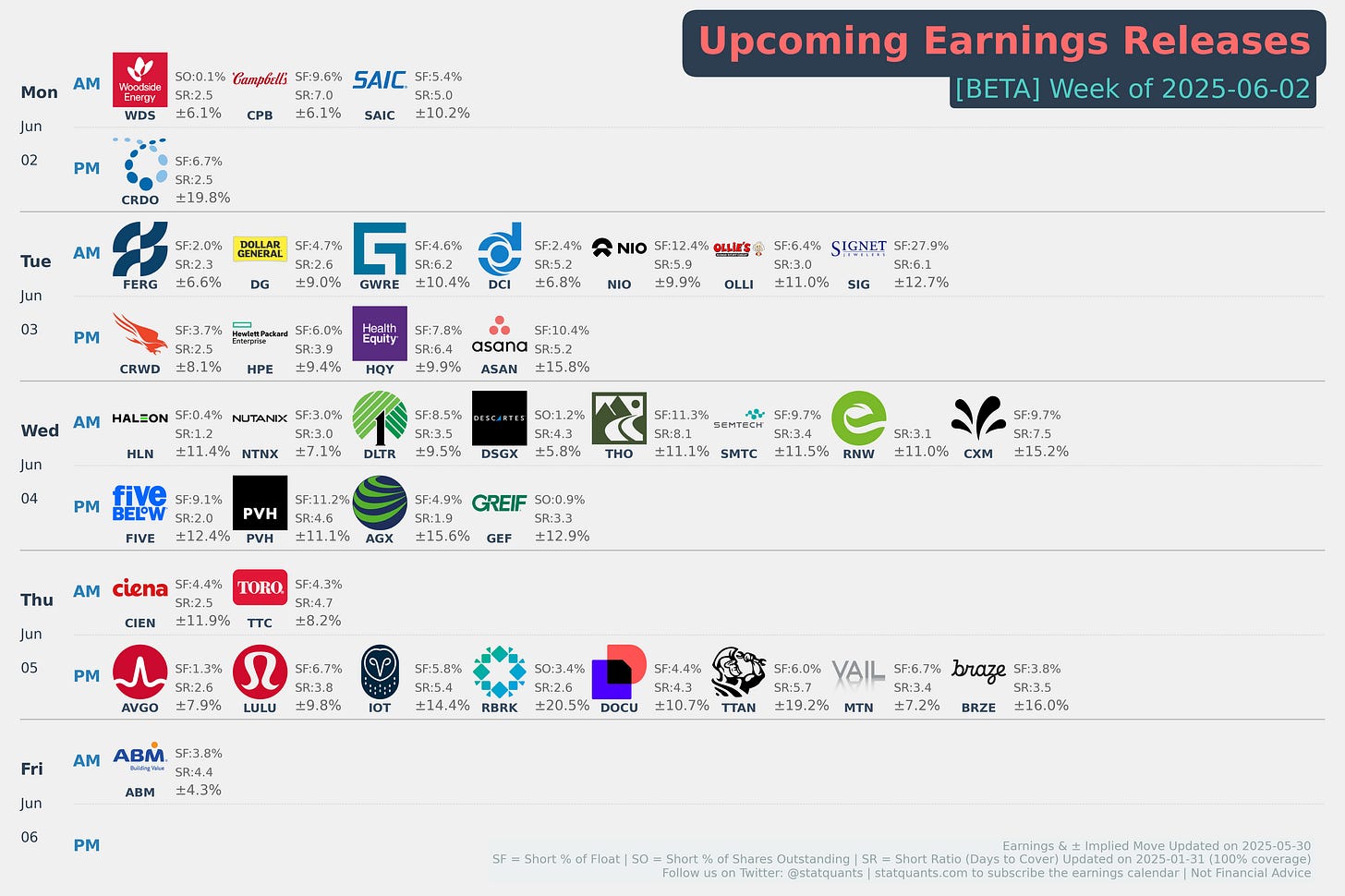

Earnings This Week

For the week of June 02, 2025, notable earnings releases for companies with a market cap above $2 billion include:

2025-06-02: AM WDS 0.00%↑ CPB 0.00%↑ SAIC 0.00%↑

2025-06-02: PM CRDO 0.00%↑

2025-06-03: AM FERG 0.00%↑ DG 0.00%↑ GWRE 0.00%↑ DCI 0.00%↑ NIO 0.00%↑

2025-06-03: PM CRWD 0.00%↑ HPE 0.00%↑ HQY 0.00%↑ ASAN 0.00%↑

2025-06-04: AM HLN 0.00%↑ NTNX 0.00%↑ DLTR 0.00%↑ DSGX 0.00%↑ THO 0.00%↑

2025-06-04: PM FIVE 0.00%↑ PVH 0.00%↑ AGX 0.00%↑ GEF 0.00%↑

2025-06-05: AM CIEN 0.00%↑ TTC 0.00%↑

2025-06-05: PM AVGO 0.00%↑ LULU 0.00%↑ IOT 0.00%↑ RBRK 0.00%↑ DOCU 0.00%↑

2025-06-06: AM ABM 0.00%↑

To add this FREE shared calendar, visit https://bit.ly/3ANoPtZ and click the ➕ "+" sign in the lower right corner. For iPhone, iPad, or any CalDAV device, don’t forget to enable iOS sync via https://calendar.google.com/calendar/u/0/syncselect