Trump Tweets, Quant Bots, and the Illusion of Control

Systematic buying dominates while investors chase performance into a changing market regime

Friday’s Thoughts, with a Monday Update

Written Friday night PDT – updated Monday morning

We didn’t get a chance to send this out Friday night, but here’s what we wrote before markets opened this week. As of Monday morning, President Trump has flipped again, and the market reversed higher in response.

It’s almost funny how he’s using the same tactic again and again: tweet something extreme (like a 25% tariff on Apple or 50% on the EU), spook the market, then reverse tone later. And just like that, S&P futures are now even higher than before his angry tweets.

The logic is clear: this is reflex training for dip buyers and a tactic to scare the speculative shorts.

This Is the Kind of Risk We Flagged a Couple of Weeks Ago

Momentum Weakened Slightly, but Every Dip Got Bought

After a relentless seven-week climb that began in early April, the S&P 500 finally showed signs of slowing down, finishing the week down 2.61%. Still, momentum remains broadly intact—every premarket dip was aggressively bought at the open. However, we also started seeing late-day reversals, with selling pressure emerging into the close. That’s a subtle but important shift in tone.

Despite the week’s decline, the move retraced less than half of the previous week’s gain, and positioning still leans bullish in the short term. We don’t view this as a decisive signal in either direction. After a 21% rally, it’s reasonable for the market to take a breather—whether this is a healthy pause before another leg higher or the end of a bear market rally depends on your framework.

Risk Still Tilts to the Upside

Valuations are stretched, but the market seems increasingly comfortable with taking on risk. Contrary to the prevailing media narrative, this hasn’t looked like a retail-driven rally. The price action has been machine-like: sharp moves timed down to nanoseconds with news flow, suggesting the primary driver is systematic and quant-driven buying.

We agree with the perspective shared in Goldman Sachs’ recent podcast, “Fade the S&P 500 Rally?”—this rally has largely been fueled by buying from quant funds and systematic strategies, squeezing shorts along the way. It may not end until one of three things happens:

the last buyer or forced buyer is exhausted,

persistent deterioration in hard data (unemployment, GDP, CPI) over multiple quarters, or

a consistent, multi-week shift in policy tone from the administration.

In the near term, we wouldn’t be surprised to see a drift lower—maybe toward 5,500—based on whatever narrative fits (Nvidia earnings, yields, Trump, take your pick) before another squeeze higher. If that happens, it could do real damage to short sellers and lure in even more performance chasers—creating the illusion that the market can’t fall.

A new high is still very much on the table at this point, given how much we’ve recovered from the April intraday 21% drop from the peak. The only question is how long it lasts before gravity kicks in. We wouldn’t be shocked by a rally of another 15%… followed by a drop of 15% sometime after.

As prices rise, firms like UBS and Morgan Stanley are playing catch-up again, upping their S&P 500 targets to 6,500 just to make headlines. Look closer, and you’ll see those targets are for mid-2026. The market is always "looking ahead."

Ignore the Noise, Stay Focused

The market’s getting smarter about Trump’s headlines. Investors know the logistics don’t add up. Apple isn’t moving iPhone production stateside anytime soon—certainly not in one presidential term. No company is making multi-billion-dollar decisions based on a tweet or a soundbite.

That said, risks remain. We may be in the early innings of a regime shift. Correlations across asset classes during recent spikes in volatility likely point to a different playbook ahead. While it's too early to say anything definitive, the signs suggest the next cycle may not resemble the last, and those relying on past strategies could find themselves out of sync.

Even if the S&P 500 still has 10% upside, there are smarter ways to beat it, with less risk and better positioning.

It’s a holiday-shortened week, so we’ll leave it there.

As always, reach out with any questions: contact@statquants.com

S&P 500 Insider Activities

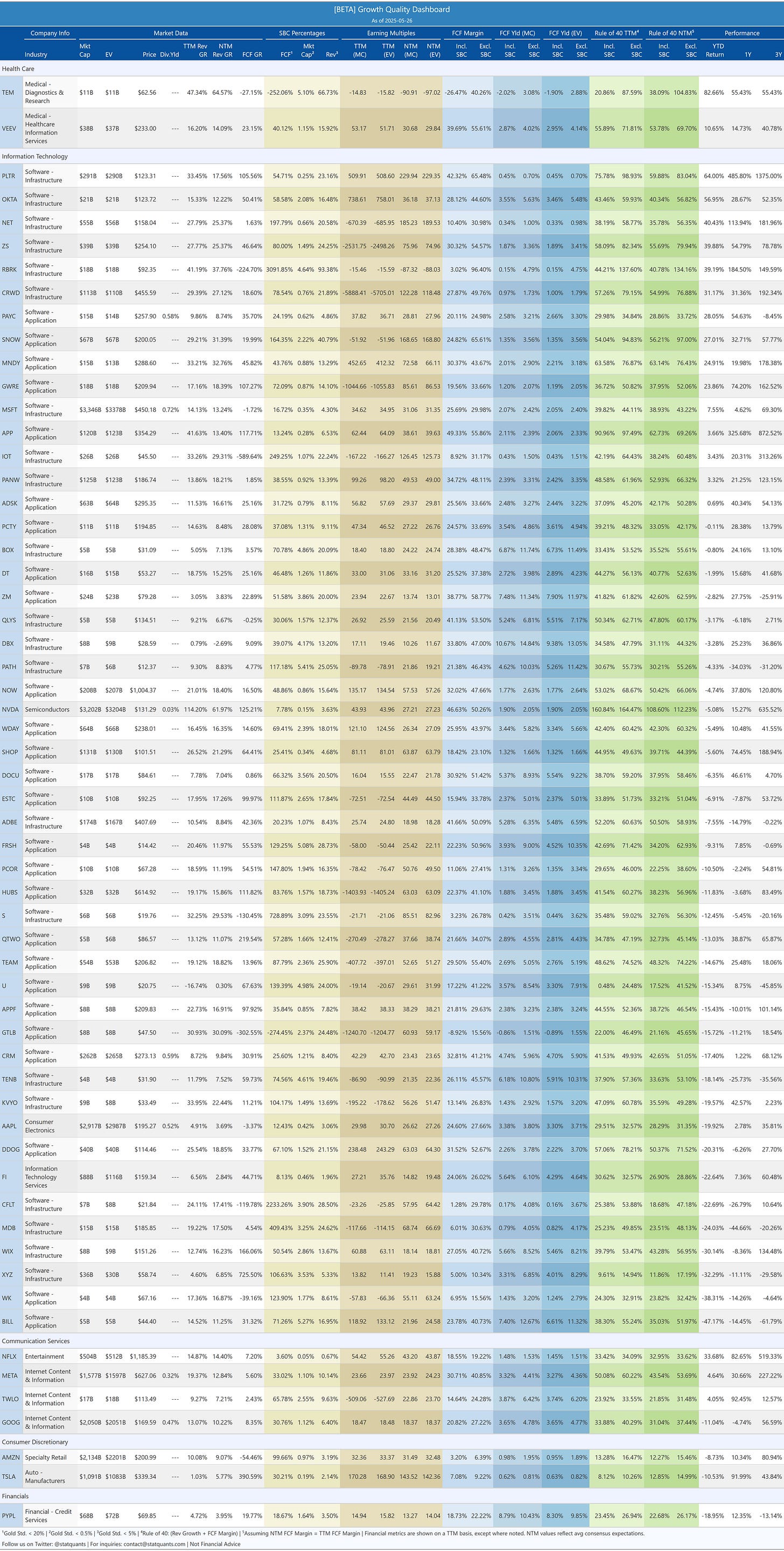

Growth Quality Dashboard (Rule of 40)

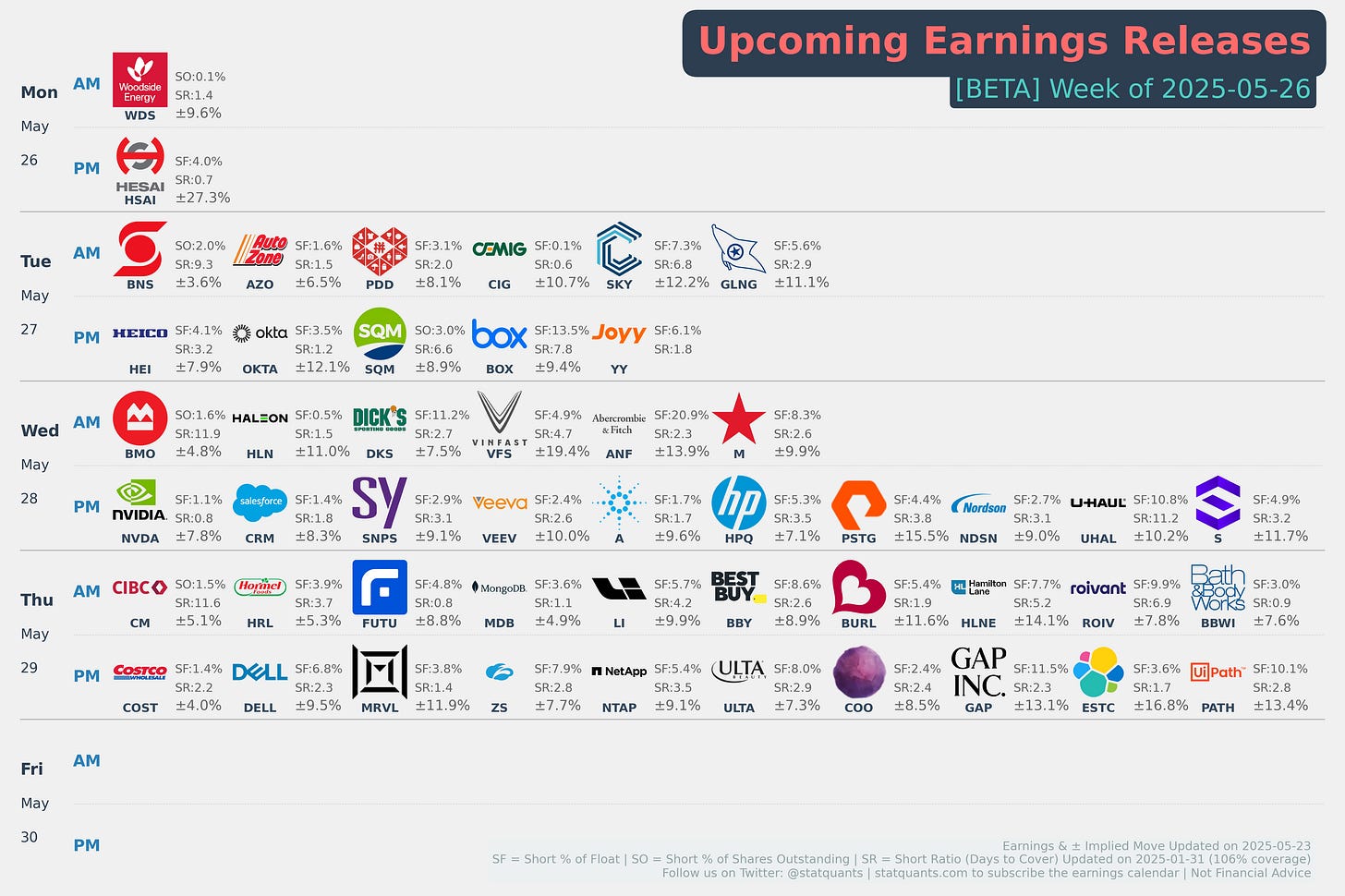

Earnings This Week

For the week of May 26, 2025, notable earnings releases for companies with a market cap above $2 billion include:

2025-05-26: AM WDS 0.00%↑

2025-05-26: PM HSAI 0.00%↑

2025-05-27: AM BNS 0.00%↑ AZO 0.00%↑ PDD 0.00%↑ CIG 0.00%↑ SKY 0.00%↑

2025-05-27: PM HEI 0.00%↑ OKTA 0.00%↑ SQM 0.00%↑ BOX 0.00%↑ YY 0.00%↑

2025-05-28: AM BMO 0.00%↑ HLN 0.00%↑ DKS 0.00%↑ VFS 0.00%↑ ANF 0.00%↑

2025-05-28: PM NVDA 0.00%↑ CRM 0.00%↑ SNPS 0.00%↑ VEEV 0.00%↑ A 0.00%↑

2025-05-29: AM CM 0.00%↑ HRL 0.00%↑ FUTU 0.00%↑ MDB 0.00%↑ LI 0.00%↑

2025-05-29: PM COST 0.00%↑ DELL 0.00%↑ MRVL 0.00%↑ ZS 0.00%↑ NTAP 0.00%↑

To add this FREE shared calendar, visit https://bit.ly/3ANoPtZ and click the ➕ "+" sign in the lower right corner. For iPhone, iPad, or any CalDAV device, don’t forget to enable iOS sync via https://calendar.google.com/calendar/u/0/syncselect