Happy Father’s Day to those celebrating. We’ll keep this update brief—market-wise, not much has changed, aside from a steady stream of headlines out of the Middle East. We’re not geopolitical analysts, so we’ll stick to what may matter for markets.

No Immediate Market Risk from the Middle East, but Watch the Tail Risks

The situation between Israel and Iran is evolving rapidly. From the looks of it, the “Rising Lion” operation appears to go beyond targeting Iran’s nuclear infrastructure—it has the markings of a broader regime-change campaign. The operation has so far gone decisively in Israel’s favor. Israel now appears to have gained effective control over Iranian airspace and demonstrated deep penetration on the ground, neutralizing key defenses and senior leadership targets with remarkable precision.

Iran’s retaliatory response—mostly via ballistic missiles and slow drones—has been scattered and ineffective, lacking both coordination and impact. Most of its missile arsenal has either been destroyed or deployed already. Without control of its airspace and with Israeli intelligence on the ground, any further launches will likely expose Iran’s remaining strategic positions and be neutralized swiftly.

Despite the scale and success of the operation, this doesn’t yet appear to be a situation that will spiral into a broader regional war. Iran likely lacks both the means and the ability to escalate further, especially via closing the Strait of Hormuz—an act that would be economically self-destructive. The wildcard remains whether Russia or China would step in to support Iran, which is one of their few regional allies of strategic value. So far, Russia has only played a diplomatic role, even evacuating its citizens from Iran—a move that suggests caution, not confrontation. China has no tradition of sending troops to foreign affairs.

Market Implications

At this stage, the conflict doesn't seem to pose an immediate risk to markets. As long as liquidity remains supportive, traders will likely continue to buy dips. Still, investors shouldn’t get too comfortable. When a conflict inches toward regime change, desperation can lead to unpredictability.

For now, we’re not looking to add risk. We’re just selling some puts for income and staying nimble.

SPX Quarterly OpEx and JPM’s Collar: Breaking the Pattern

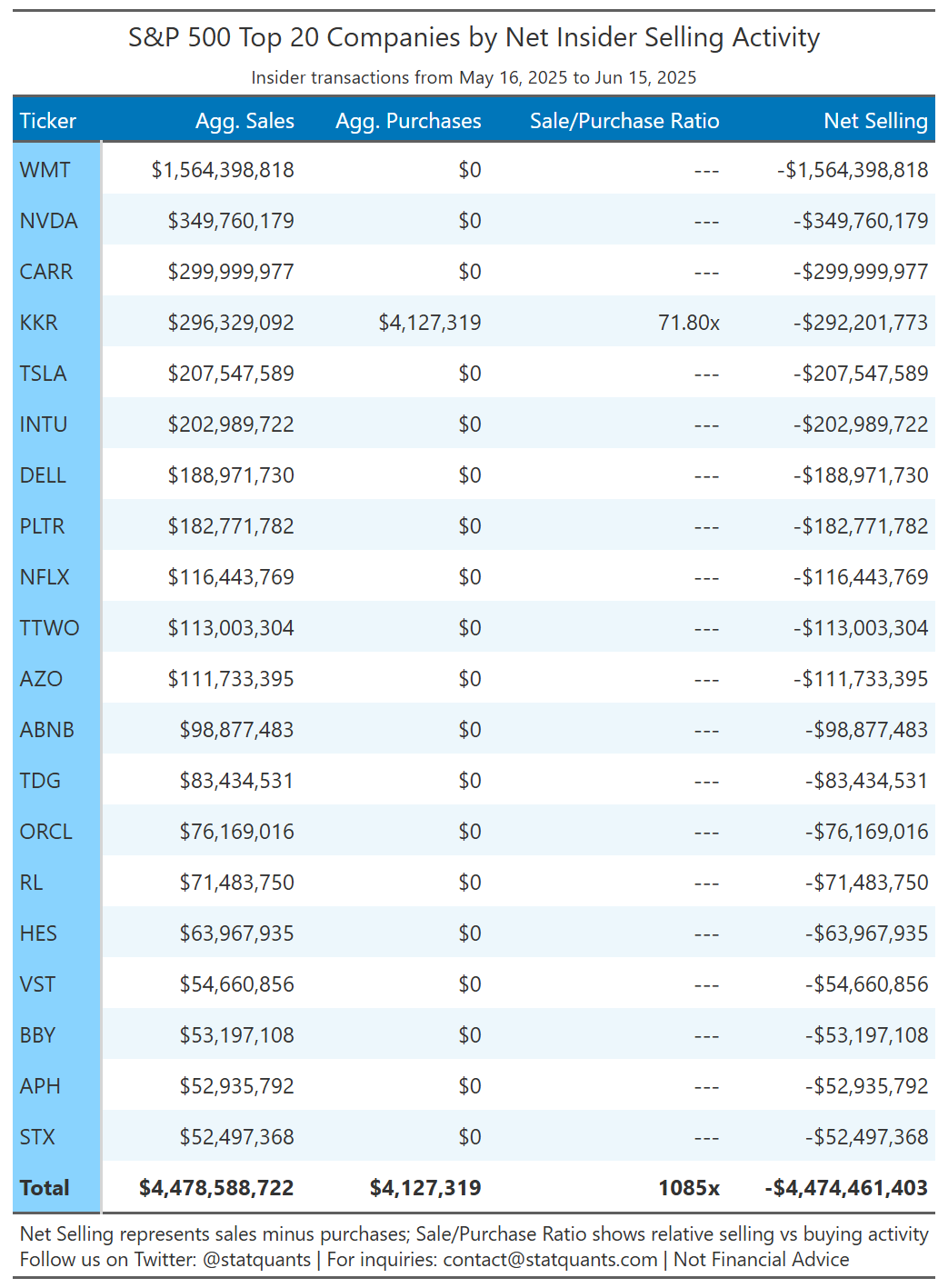

S&P 500 Insider Activities

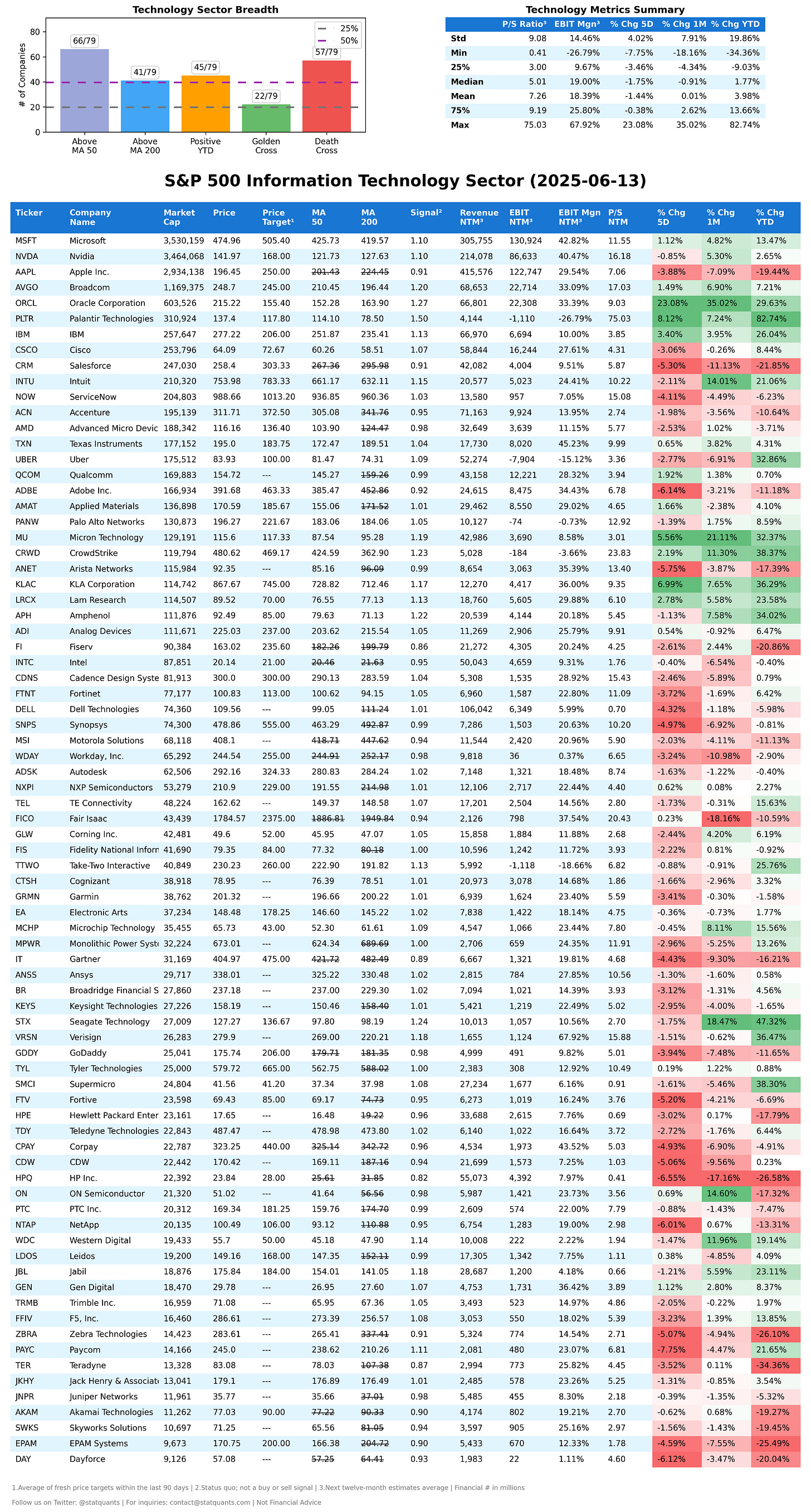

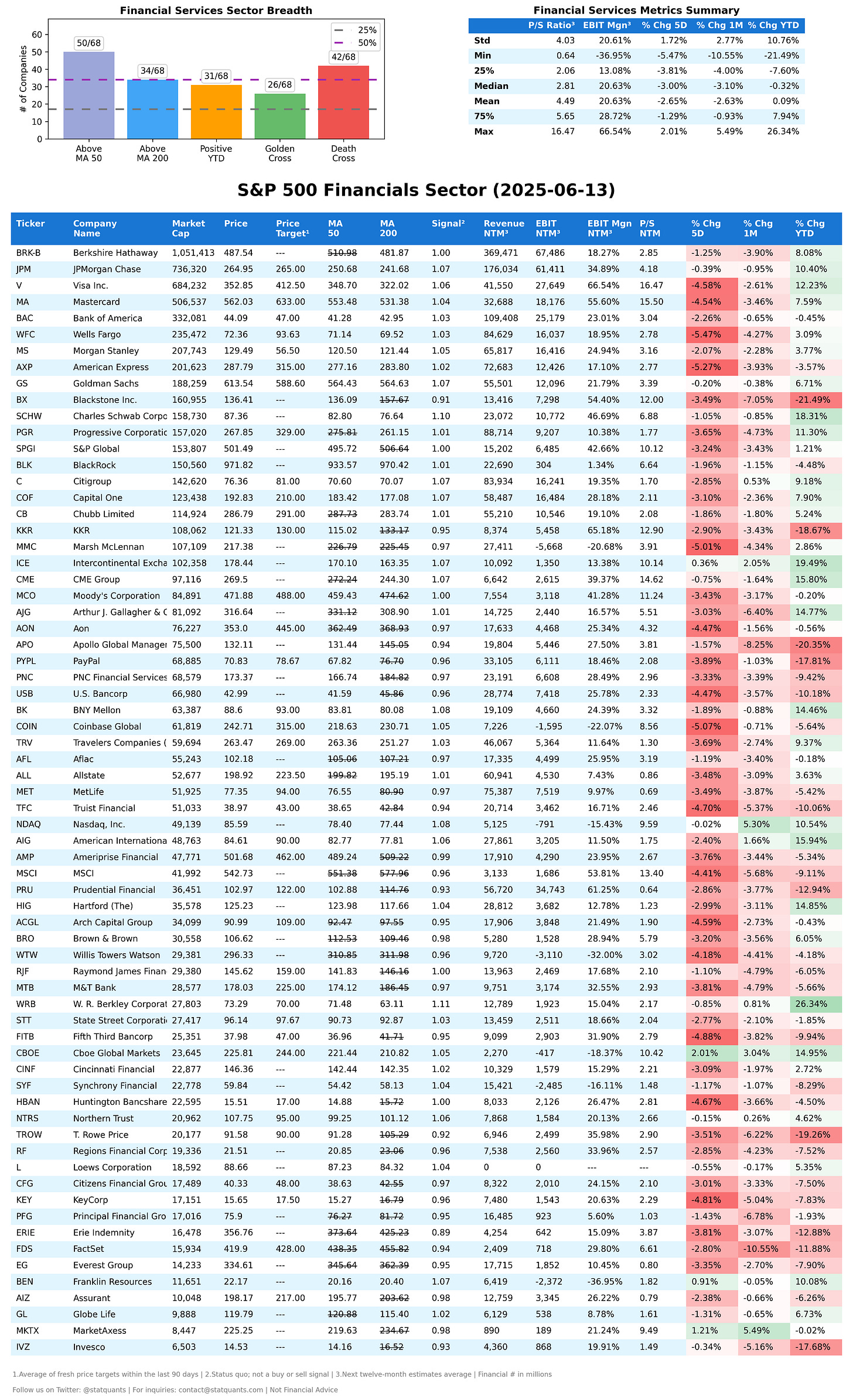

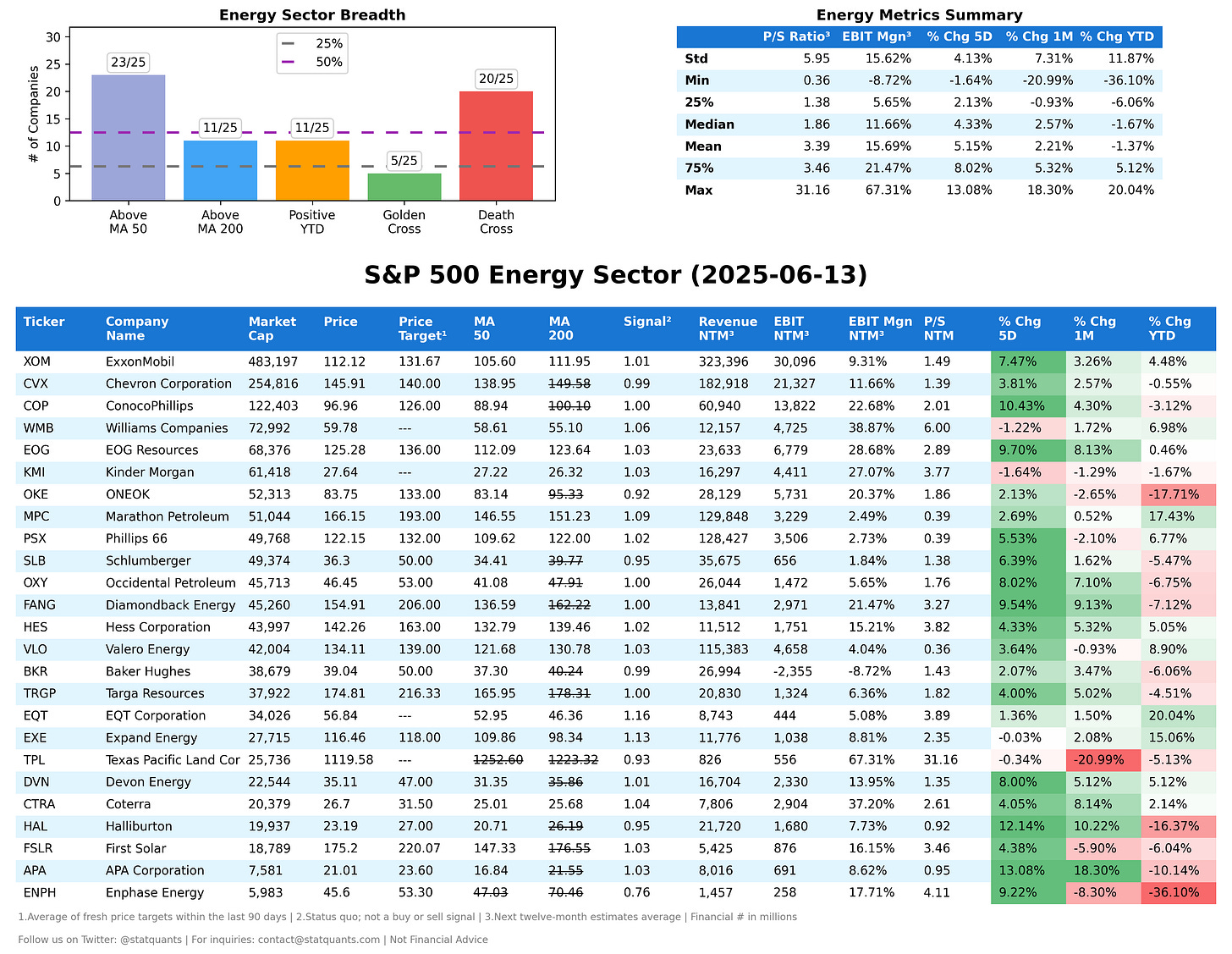

Growth Quality Dashboard (Rule of 40)

Earnings This Week

For the week of June 16, 2025, notable earnings releases for companies with a market cap above $2 billion include:

2025-06-16: AM RNW 0.00%↑

2025-06-16: PM LEN 0.00%↑

2025-06-17: AM JBL 0.00%↑ CIG 0.00%↑ PDCO 0.00%↑ WLY 0.00%↑

2025-06-18: AM HLN 0.00%↑ KFY 0.00%↑ HCM 0.00%↑ GMS 0.00%↑

2025-06-20: AM ACN 0.00%↑ KR 0.00%↑ DRI 0.00%↑ KMX 0.00%↑

To add this FREE shared calendar, visit https://bit.ly/3ANoPtZ and click the ➕ "+" sign in the lower right corner. For iPhone, iPad, or any CalDAV device, don’t forget to enable iOS sync via https://calendar.google.com/calendar/u/0/syncselect